21st Austria weekly - DO & CO, Vienna Airport (14/11/2024)

17.11.2024, 1497 Zeichen

DO & CO: Catering company DO & CO benefited from increased demand in all divisions and, with sales of € 1,131.14m (PY: € 880.11m) DO & CO is reporting the strongest half year in terms of revenue in the Company’s history. This constitutes an increase in revenue by € 251.03m or 28.5 % as compared to the same period of the previous year. Consolidated earnings before interest and tax (EBIT) of the DO & CO Group amounted to € 83.37m for the first half year of the business year 2024/2025, € 18.26m higher than in the same period of the previous year. The EBIT margin was 7.4 % (PY: 7.4 %). Compared to the first half year of the business year 2023/2024, the net result increased by 24.6 %, from € 35.48m in the previous year to € 44.22m.

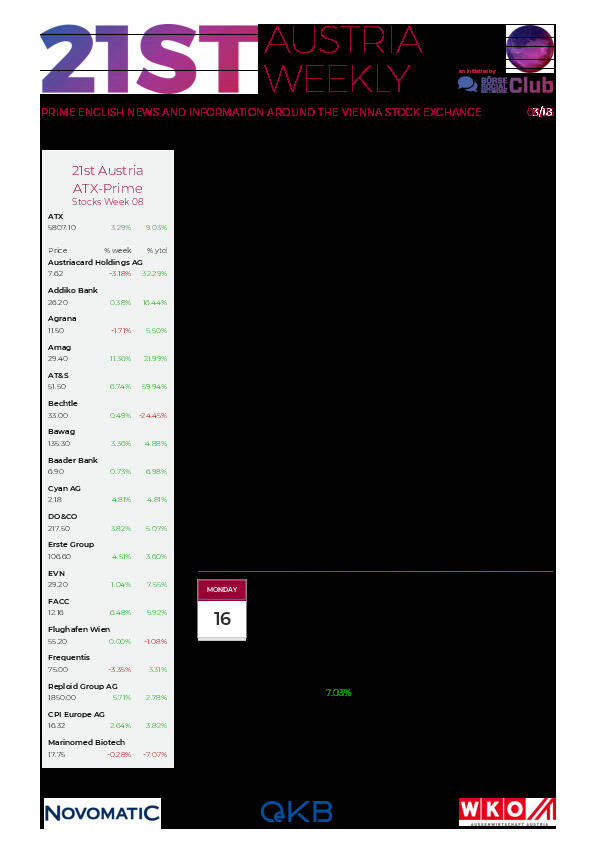

DO&CO: weekly performance:

Vienna Airport: In Q1-3/2024, the Flughafen Wien Group generated revenue of € 792.5 million, comprising a year-on-year increase of 13.3% from the first three quarters of 2023. EBITDA rose to € 368,1 million compared to the prior-year figure in Q1-3/2023, whereas EBIT climbed to € 268.7 million. The Group net profit before non-controlling interests rose to € 207.0 million in Q1-3/2024. This earnings growth can be attributed to the good operating development and a clearly positive financial result. The cash flow from operating activities totalled € 322.1 million (Q1-3/2023: € 319.8 million).

Flughafen Wien: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (14/11/2024)

Wiener Börse Party #1099: Wiener Börse zum Februar-Verfall fester, aber mit kleiner Enttäuschung, positive Spannungsmomente bei der Porr

Bildnachweis

Aktien auf dem Radar:Kapsch TrafficCom, Strabag, Agrana, Bajaj Mobility AG, Addiko Bank, Austriacard Holdings AG, Amag, Rosgix, DO&CO, Porr, FACC, BKS Bank Stamm, Oberbank AG Stamm, Reploid Group AG, Josef Manner & Comp. AG, UBM, CA Immo, EuroTeleSites AG, EVN, Flughafen Wien, CPI Europe AG, OMV, Österreichische Post, Telekom Austria, Verbund, Fresenius Medical Care, Allianz, HeidelbergCement, Deutsche Post, Scout24, Bayer.

Random Partner

RBI

Die Raiffeisen Bank International ist eine der führenden Corporate- und Investment-Banken Österreichs und in 11 Märkten Zentral- und Osteuropas als Universalbank tätig. Darüber hinaus bietet der RBI-Konzern zahlreiche weitere Finanzdienstleistungen an, zum Beispiel in den Bereichen Leasing, Asset Management und M&A.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten