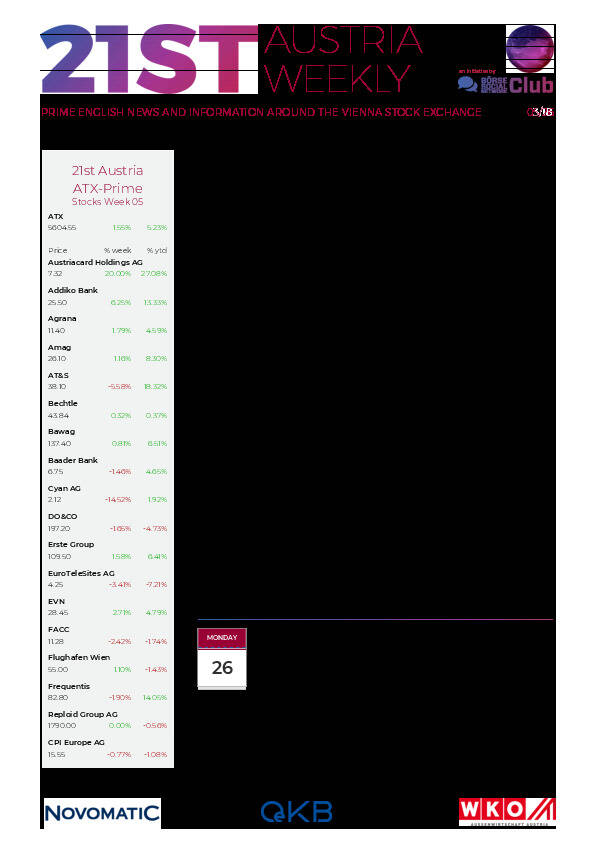

21st Austria weekly - Semperit, Palfinger, Addiko (06/03/2025)

09.03.2025, 2154 Zeichen

Semperit: Semperit AG Holding aims to propose to the Annual General Meeting a dividend of EUR 0.50 per share for the financial year 2024. For the 2023 financial year, the dividend also amounted to EUR 0.50 per share. This dividend would result in a higher payout ratio than foreseen in Semperit Group's dividend policy, which in principle aims to distribute around 50% of earnings after taxes. The Executive Board justified this with the good liquidity situation and the development of the free cash flow (before the sale of companies) in the past financial year. The annual results for 2024 will be published on March 20, 2025 and the Annual General Meeting will be held on April 23, 2025.

Semperit: weekly performance:

Palfinger: Lifting solutions Palfinger AG looks back on a very successful fiscal year. In 2024, revenue of EUR 2.36 billion and an operating result of EUR 185.6 million were achieved. The targeted reduction in working capital at the end of the year generated a strong free cash flow of EUR 119.5 million, enabling a further reduction in net financial debt. "The waste management and recycling, forestry, public sector, marine, as well as transportation and logistics industries are becoming increasingly important and already accounted for 65% of revenue in 2024. This diversification was a key factor in last year's success," explained Andreas Klauser, CEO of PALFINGER AG.

Palfinger: weekly performance:

Addiko: Addiko Group, a Consumer and SME specialist bank active across Central and South-Eastern Europe (CSEE), achieved a full-year profit after tax of €45.4m, driven by strong business development in the Consumer segment and focused cost management. The result was impacted by one-off costs of €3m related to the takeover bids. Net interest income rose by 6.5% to €242.9m (YE23: €228.0m) with NIM at 3.87% (YE23: 3.75%). The net fee and commission income increased by 8.7% YoY to €73.0m (YE23: €67.1m), mainly driven by a product push in accounts & packages, bancassurance and credit cards.

Addiko Bank: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (06/03/2025)

Börsepeople im Podcast S23/11: Daniela Herneth

Bildnachweis

Aktien auf dem Radar:AT&S, OMV, Lenzing, Amag, EuroTeleSites AG, Zumtobel, Österreichische Post, DO&CO, Josef Manner & Comp. AG, Rath AG, RBI, Semperit, Warimpex, Telekom Austria, BKS Bank Stamm, Oberbank AG Stamm, Austriacard Holdings AG, Agrana, CA Immo, EVN, Flughafen Wien, Frequentis, CPI Europe AG, Verbund, Rheinmetall.

Random Partner

Erste Asset Management

Die Erste Asset Management versteht sich als internationaler Vermögensverwalter und Asset Manager mit einer starken Position in Zentral- und Osteuropa. Hinter der Erste Asset Management steht die Finanzkraft der Erste Group Bank AG. Den Kunden wird ein breit gefächertes Spektrum an Investmentfonds und Vermögensverwaltungslösungen geboten.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten