21st Austria weekly - AMAG, Kontron, RBI, Vienna Stock Exchange (06/05/2025)

11.05.2025, 5022 Zeichen

AMAG: AMAG Austria Metall AG recorded increases in both revenue and earnings in the first quarter of 2025. In addition to an almost +10% increase in shipments in the Rolling Division, a higher aluminium price and higher premiums in the Metal Division had a positive effect. As expected, the difficult environment in the European automotive industry made itself felt in the Casting Division. AMAG Group's revenues grew by almost +20% to EUR 401.4 million (Q1/2024: EUR 335.8 million) as a result of higher shipment volumes and a higher aluminium price. Total shipments in Q1/2025 grew by around +6% to 110,800 tonnes (Q1/2024: 104,200 tonnes). Earnings before interest, taxes, depreciation and amortisation (EBITDA) increased by around +9% to EUR 46.1 million after EUR 42.4 million in the first quarter of the previous year. Helmut Kaufmann, Chief Executive Officer of AMAG: "The current economic environment is characterised by increased uncertainties as a result of the diverse and fluctuating trade policy measures. These considerable volatilities require the ability to adapt rapidly – a quality that characterises us as AMAG. We will act in our usual flexible and customer-orientated manner. Nevertheless, it can be assumed that the upheavals in the global economy will also affect AMAG's business development.”

Amag: weekly performance:

Kontron: IoT company Kontron increased its revenue in the first quarter of 2025 by 8.2% year-over-year to EUR 385.4 million (PY: EUR 356.1 million). At the same time, the quality of revenue improved significantly, with the gross margin rising to 44.0%, up from 41.3% in the prior year, resulting in a 15.1% increase in value creation. This substantial rise is due to the growing share of high-margin revenue from the Software + Solutions segment. In Q1 2025, the segment contributed 34.9% of total revenue (PY: 29.8%) with an EBITDA margin of 19.9% (PY: 17.7%). Operating profit (EBITDA) saw particularly strong growth, increasing by 35.6% to EUR 48.0 million (PY: EUR 35.4 million). The EBITDA margin improved significantly to 12.4% (PY: 10.0%). Group earnings after minority interests rose to EUR 20.1 million (PY: EUR 16.3 million), or EUR 0.33 per share (PY: EUR 0.26).

Kontron: weekly performance:

RBI: Raiffeisen Bank International (RBI) reported a consolidated profit of EUR 260 million in its core Group (excluding Russia) in the first quarter of 2025. Net interest income was stable year-on-year despite interest rate cuts in most of RBI's markets, whereas net fee and commission income increased by 8.3 per cent. The decline in consolidated profit in the core Group year-on-year (minus EUR 43 million) was mainly due to an increase in general administrative expenses. Loans to customers in the core Group increased by 0.7 per cent to around EUR 96 billion compared to the end of 2024. RBI's CET1 ratio excluding Russia was around 15.9 per cent at the end of the first quarter of 2025. When calculating this ratio, RBI assumes a worst-case scenario in which Raiffeisenbank Russia would be deconsolidated with a full loss of the equity. “The result once again underscores RBI's earnings strength. We were able to maintain our net interest income despite falling interest rates, and our net commission income continues to develop well,” said RBI CEO Johann Strobl. “We have further strengthened the CET1 ratio in the core Group and are thus prepared for any scenario in Russia,” Strobl added.

RBI: weekly performance:

Vienna Stock Exchange: The Vienna-Prague Stock Exchange Group closed the 2024 financial year with record figures, underlining its strategic importance for the region. Strategic business diversification, a surge in equity turnover and an all-time high in debt listings contributed to this strong performance. Earnings before taxes surpassed the EUR 50 million mark for the first time in company history. Nearly 92% of revenues were generated abroad, reflecting the success of the Group’s international growth strategy. Earnings before taxes reached EUR 50.1 million (2023: EUR 47.9 million), thus leading a series of financial years at record levels. Group revenues grew to EUR 81.8 million (2023: EUR 78.9 million) with 92% generated abroad. Equity increased to EUR 184.3 million (2023: EUR 177.9 million), while the net profit for 2024 of EUR 37.3 million exceeded the previous year's level (2023: EUR 36.4 million). "The Austrian stock market soared last year and hit a historic milestone in 2025 by surpassing the 10,000 mark. Even amid a more volatile global environment, Austrian equities continue to stand out due to their attractive valuations and the strong economic ties to the dynamic growth markets of Central and Eastern Europe. Our strong business performance reflects the effectiveness of our strategy and the strength of the regional market environment," says Christoph Boschan, CEO of Wiener Boerse AG.

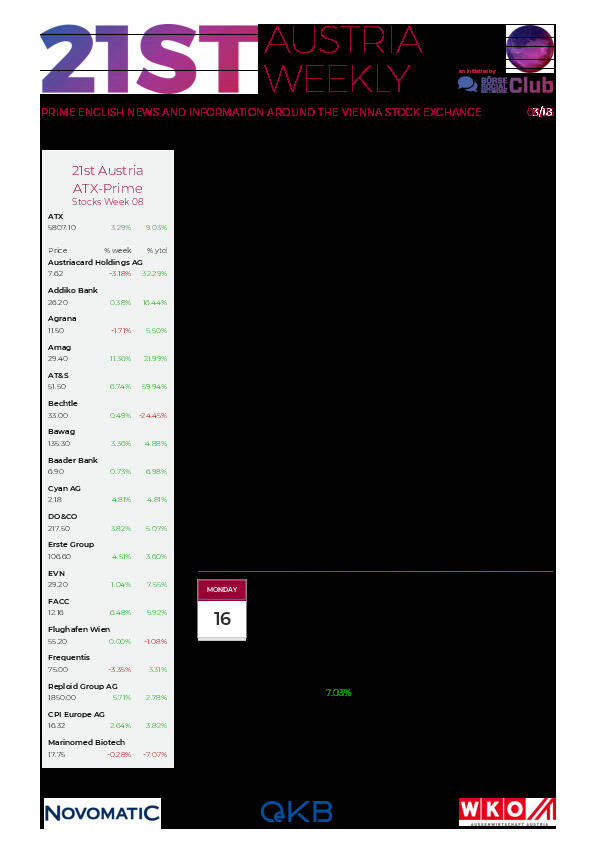

ATX Prime: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (06/05/2025)

Wiener Börse Party #1101: ATX verliert heute deutlicher, Verbund über 60, aber bei der ATX Five Quali hinten, Song mit Porr-CFO Klemens Eiter

Bildnachweis

Aktien auf dem Radar:FACC, UBM, Strabag, Austriacard Holdings AG, Polytec Group, Palfinger, Amag, Rosgix, Bajaj Mobility AG, AT&S, Wienerberger, Lenzing, Telekom Austria, Addiko Bank, Bawag, Erste Group, Gurktaler AG Stamm, Heid AG, RHI Magnesita, BKS Bank Stamm, SW Umwelttechnik, Oberbank AG Stamm, EuroTeleSites AG, Frequentis, CA Immo, EVN, Flughafen Wien, CPI Europe AG, OMV, Österreichische Post, Verbund.

Random Partner

Verbund

Verbund ist Österreichs führendes Stromunternehmen und einer der größten Stromerzeuger aus Wasserkraft in Europa. Mit Tochterunternehmen und Partnern ist Verbund von der Stromerzeugung über den Transport bis zum internationalen Handel und Vertrieb aktiv. Seit 1988 ist Verbund an der Börse.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten