21st Austria weekly - UBM, Warimpex, Austrian Post:, Strabag (29/09/2025)

05.10.2025, 3298 Zeichen

UBM: Real estate developer UBM is planning the issue of another green bond with a five-year term (2025-2030), an interest rate of 6.75% per year and a denomination of EUR 500.00. The issue volume of the UBM Green Bond is expected to total up to EUR 100m, with a possible increase to up to EUR 120m. The bond volume will be based, above all, on the acceptance rate of the exchange offer which relates to both the UBM Bond 2019-2025 and the UBM Bond 2021-2026 (Exchange Offer). Upon completion of the Exchange Offer, presumably on 16 October 2025, the remaining bonds of the Green Bond 2025 (2025 UBM Bonds) will be offered for subscription by way of a public offer subject to a prospectus in Austria, Germany and Luxembourg and in other countries through a private placement. Interested investors may subscribe for the 2025 UBM Bonds in the period from 20 October to presumably 24 October 2025. UBM intends to use the net issue proceeds of the Green Bond 2025 for the potential refinancing of existing financing of the Issuer or for the full or partial financing and/or refinancing of new or existing suitable green projects.

UBM: weekly performance:

Warimpex: Warimpex Financing PL Sp.z.o.o., a wholly owned subsidiary of Warimpex Finanz- und Beteiligungs AG, which is listed on the stock exchanges in Vienna and Warsaw, has successfully issued an unsecured bond in Poland with a total volume of roughly EUR 4.9 million (PLN 21 million). The bond has a term of three years, a margin of 5.5 per cent, and will primarily be used to finance ongoing project developments in Poland. Due to the strong investor demand, the originally planned issue volume of approximately EUR 2.3 million (PLN 10 million) was increased to around EUR 4.9 million (PLN 21 million). The demand significantly exceeded the expectations – subscriptions amounting to nearly EUR 8.9 million (PLN 38 million) were submitted, leading to a 44.18 per cent reduction of the allocations. Warimpex CFO Daniel Folian: “We are very pleased to return to the Polish capital market with a bond after more than a decade, and we plan to make greater use of this form of financing again in the future.”

Warimpex: weekly performance:

Austrian Post: Austrian Post has officially opened its new base in Weiz to meet the sharply increasing parcel volumes. The new location in 8160 Weiz has a usable area of around 1,900 m². The almost 60 employees sort and deliver around 2,300 parcels per day, as well as letters, brochures, newspapers and magazines in Weiz and the surrounding communities.

Österreichische Post: weekly performance:

Strabag: On behalf of OMV Strabag and Siemens Energy are building one of Europe's largest electrolysis plants. The 140 MW plant in Bruck an der Leitha is scheduled to go into operation at the end of 2027. OMV will produce up to 23,000 tons of hydrogen annually in future using renewable energy from wind, solar, and hydropower, making a significant contribution toward reducing the company’s carbon emissions. Siemens Energy will bring extensive expertise in electrolysis technology and plant construction, while STRABAG will be responsible for the entire civil construction work.

Strabag: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (29/09/2025)

Wiener Börse Party #1100: ATX etwas stärker, AT&S vorne, vor Changes im ATX Five, Uhrzeiten für Best of Austro-IR beim 2. Aktientag fixiert

Bildnachweis

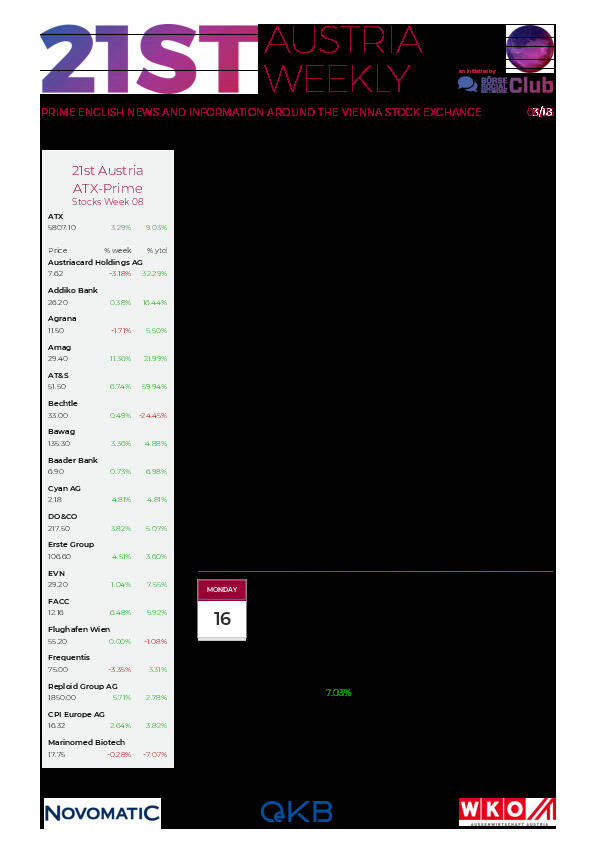

Aktien auf dem Radar:FACC, Kapsch TrafficCom, Agrana, Austriacard Holdings AG, Bajaj Mobility AG, Addiko Bank, Amag, Rosgix, CA Immo, Wienerberger, Lenzing, Mayr-Melnhof, AT&S, Rath AG, Wiener Privatbank, BKS Bank Stamm, Oberbank AG Stamm, SW Umwelttechnik, Josef Manner & Comp. AG, Frequentis, EuroTeleSites AG, EVN, Flughafen Wien, CPI Europe AG, OMV, Österreichische Post, Telekom Austria, UBM, Verbund.

Random Partner

DADAT Bank

Die DADAT Bank positioniert sich als moderne, zukunftsweisende Direktbank für Giro-Kunden, Sparer, Anleger und Trader. Alle Produkte und Dienstleistungen werden ausschließlich online angeboten. Die Bank mit Sitz in Salzburg beschäftigt rund 30 Mitarbeiter und ist als Marke der Bankhaus Schelhammer & Schattera AG Teil der GRAWE Bankengruppe.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten