21st Austria weekly - Agrana (09/10/2025)

12.10.2025, 1570 Zeichen

Agrana: The food and industrial goods group Agrana in the first half of the 2025|26 financial year registered a reduction of 50.5% in operating profit (EBIT) to € 28.0 million. The Group’s revenue decreased by 9.1% to € 1,691.6 million (H1 previous year: € 1,861.7 million). Nevertheless, thanks to very good second-quarter results in the Food & Beverage Solutions business, Agrana has raised its forecast for the year and now expects a significant increase in Group EBIT of between 10% and 50%. EBIT is now projected to be in the range of about € 45 to 60 million for the 2025|26 financial year; this takes into account that the outlook for the Agricultural Commodities & Specialities business (the Starch and Sugar segments) remains subdued. Agrana CEO Stephan Büttner says: "We are still in a challenging transformation phase as we implement NEXT LEVEL, our new Group strategy. While the results in Food & Beverage Solutions were very positive, the operating performance in the Sugar and Starch businesses was unsatisfactory. Additionally, as announced, non-recurring expenses (primarily staff costs) were recognised in the Sugar segment as part of the restructuring in Austria and the Czech Republic. The strong earnings contribution from the Food & Beverage Solutions segment not only was a stabilising factor for Group EBIT in the first half of the year, but also forms the main basis for our updated EBIT forecast for the full year 2025|26.”

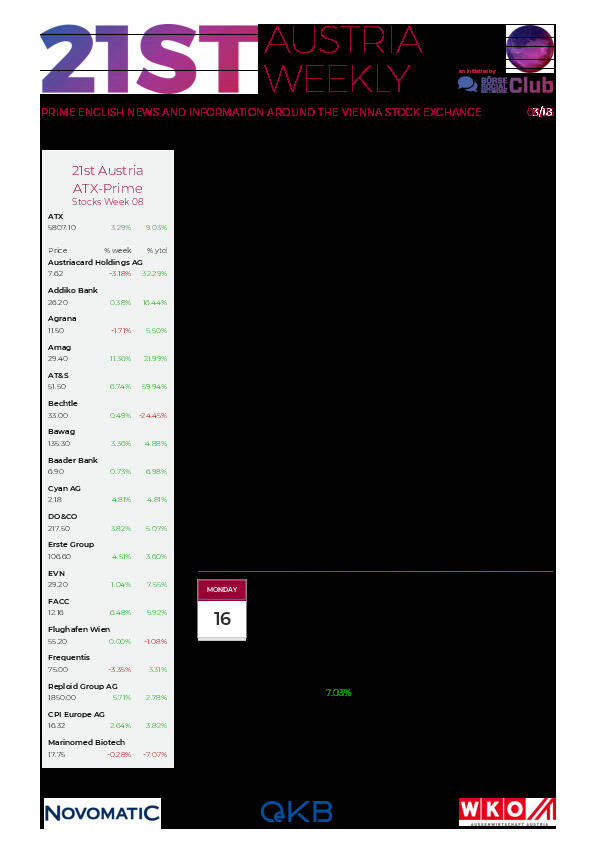

Agrana: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (09/10/2025)

Wiener Börse Party #1102: ATX deutlich erholt, heute FACC-Day an der Wiener Börse, spannende News bei cyan, Aufschlag Erich Hampel

Bildnachweis

Aktien auf dem Radar:FACC, Amag, Strabag, Austriacard Holdings AG, Polytec Group, Flughafen Wien, Rosgix, EuroTeleSites AG, Wienerberger, Telekom Austria, AT&S, Hutter & Schrantz Stahlbau, SBO, RHI Magnesita, BKS Bank Stamm, Oberbank AG Stamm, Athos Immobilien, CA Immo, EVN, CPI Europe AG, OMV, Bajaj Mobility AG, Österreichische Post, UBM, Verbund, Deutsche Telekom, Münchener Rück, Vonovia SE, Siemens Energy, Fresenius Medical Care, Infineon.

Random Partner

Strabag

Strabag SE ist ein europäischer Technologiekonzern für Baudienstleistungen. Das Angebot umfasst sämtliche Bereiche der Bauindustrie und deckt die gesamte Bauwertschöpfungskette ab. Durch das Engagement der knapp 72.000 MitarbeiterInnen erwirtschaftet das Unternehmen jährlich eine Leistung von rund 14 Mrd. Euro (Stand 06/17).

>> Besuchen Sie 53 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten