21st Austria weekly - Austrian Post, Wienerberger, AT&S, Verbund, UBM Development (12/05/2021)

16.05.2021, 4349 Zeichen

Austrian Post: Austrian Post's Group revenue increased by 28.5 % in the first quarter of 2021 to Euro 646.1 mn. This was driven by a solid core business, as parcel growth has sufficiently offset the mail business decline, as well as due to the full consolidation of the Turkish company Aras Kargo. In the period under review, the Parcel & Logistics Division generated revenue of Euro 323.7 mn, slightly above the Mail Division revenue of Euro 311.0 mn for the very first time. Consistent implementation of the company's strategy made this structural change possible. The Retail & Bank Division also produced growth, reporting revenue of Euro 16.7 mn in the first quarter of 2021. bank99 has been offering its own range of financial services since April 2020. Austrian Post's earnings grew substantially year-on-year. Group EBITDA rose by 51.5 % to Euro 99.0m and EBIT was up by 79.2 % to Euro 59.8 mn.

Österreichische Post: weekly performance:

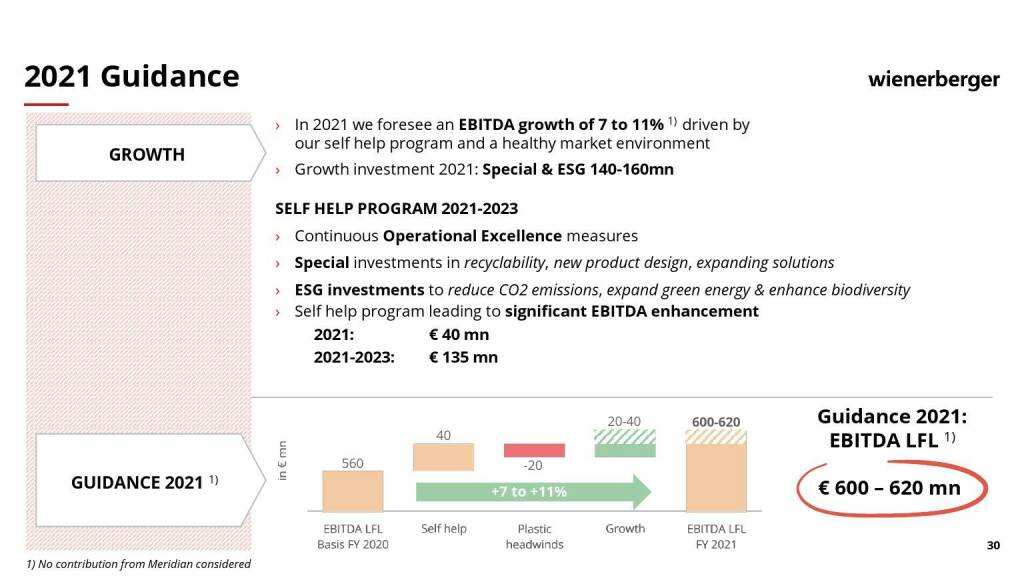

Wienerberger: Despite a challenging market environment, brick maker Wienerberger has achieved Group revenues of Euro 796.5 mn (2020: EUR 793.3 million) and EBITDA LFL of Euro 107.2 mn (2020: Euro 107.7 min). By focusing on its core segments - new build, renovation and infrastructure -Wienerberger has once again demonstrated its strong market position across all its Business Units. Proactive and forward-looking management of procurement, inventory and logistics, as well as high reactivity in our local markets, have underpinned our ability to deliver consistently to our customers in the face of strong raw material price increases and bottlenecks in raw material supply. This has enabled us to further strengthen our market position, especially in Wienerberger Piping Solutions.

Wienerberger: weekly performance:

AT&S: The Management Board of printed circuit board producer AT&S decided to propose a dividend of Euro 0.39 per share for the financial year 2020/21 (PY: Euro 0.25 per share) to the 27th Annual General Meeting on 8 July 2021. According to the company, this proposal for the distribution of profits reflects the positive development in the past financial year and the upcoming investments in additional capacities and new technologies.

AT&S: weekly performance:

Verbund: Austrian utility company Verbund presented Q1 figures. Earnings figures for quarter 1/2021 were down slightly, due mainly to a year-on-year drop in production of electricity from hydropower attributable to a lower water supply. EBITDA decreased by 8.6% to Euro 302.7 mn, and the Group result fell by 7.6% to Euro 144.7 mn. The hydro coefficient for the run-of-river power plants in quarter 1/2021 came to 0.99, which is 1 percentage point below the long-term average and 10 percentage points below the year-ago figure. Generation from annual storage power plants also decreased substantially in quarter 1/2021 due to market conditions. Overall, generation from hydropower was down 11.2% on the previous year’s level. However, the marked increase in wholesale electricity prices on the spot markets gave a boost to earnings – unlike futures market prices, which declined in the relevant period. The average sales price for our own generation from hydropower increased by Euro 1.7/MWh to Euro 47.6/MWh. Based on expectations of average own generation from hydropower and wind power in quarters 2–4/2021 and the opportunities and risks identified, Verbund currently expects EBITDA of between around Euro 1,130 mn and Euro 1,300 mn and a Group result of between around Euro 480 mn and Euro 590 mn in financial year 2021.

Verbund: weekly performance:

UBM Development: The 3.125% sustainability-linked UBM bond 2021 was successfully placed and the books were closed after only two hours on the first day of the cash subscription period. Due to the demand, the volume was increased from Euro 125 mn to Euro 150 mn at short notice. “We are extremely pleased over the success story of our first sustainability-linked bond and the strong confidence of investors in UBM as an issuer and in our strategy“, commented Patric Thate, CFO of UBM Development AG, and added: “Our financial strength is a key competitive advantage, and this issue will allow us to react very quickly to market opportunities.“

UBM: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (12/05/2021)

Wiener Börse Party #638: I wer narrisch bei Palfinger und VIG, Gratulation an Mike Lielacher und ein Bundesschätze-Wunsch

Bildnachweis

Random Partner

Uniqa

Die Uniqa Group ist eine führende Versicherungsgruppe, die in Österreich und Zentral- und Osteuropa tätig ist. Die Gruppe ist mit ihren mehr als 20.000 Mitarbeitern und rund 40 Gesellschaften in 18 Ländern vor Ort und hat mehr als 10 Millionen Kunden.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

-

20:16

-

20:16

-

19:14

-

25.04.

-

19:02

-

18:39

-

18:39

-

18:37

-

18:37

-

18:30

-

18:25

-

18:22

-

18:17

-

18:05

-

18:05

-

17:38

-

17:20

-

17:16

-

17:03

-

17:01

-

16:57

-

16:49

-

15:52

-

15:20

-

15:14

-

15:00

-

14:40

-

14:20

-

14:00

-

14:00

-

14:00

-

13:35

-

13:35

-

13:22

-

13:18

-

13:12

-

12:42

-

12:42

-

12:35

-

12:20

-

12:14

-

12:14

-

12:09

-

12:06

-

12:06

-

11:44

-

11:37

-

11:37

-

11:33

-

11:33

-

11:33