RHI AG / Preliminary results 2016

14.03.2017, 11812 Zeichen

Corporate news transmitted by euro adhoc. The issuer/originator is solely responsible for the content of this announcement.

annual result

The RHI Group's revenue amounted to EUR 1,651.2 million in the past financial year compared with EUR 1,752.5 million in the year 2015. This decline is primarily attributable to the continued moderate steel production and lower project deliveries in the business segments outside the steel industry.

The operating EBIT amounted to EUR 123.2 million in the past financial year and was maintained at the level of 2015 despite weak markets and one-off costs of roughly EUR 12 million related to the planned combination with Magnesita. This positive operating business development is predominantly attributable to the good earnings situation in the Steel Division, the improved operating EBIT in the Raw Materials Division due to good capacity utilization at the Austrian raw material plants and cost reductions in all areas of the company.

EBIT amounted to EUR 116.1 million in the past financial year and includes a full impairment of the assets of the two production sites for fused cast products for the glass industry totaling EUR 8.0 million. Moreover, negative effects on earnings of EUR 4.6 million from the deconsolidation of the US subsidiary RHI Monofrax, LLC following its sale and EUR 4.8 million related to the social plan for personnel cuts and the reorganization of the production portfolio at the Norwegian site in Porsgrunn are included. In contrast, a positive effect of EUR 10.1 million resulted from the measurement of the power supply contract in Norway.

Finance costs amounted to EUR (21.2) million in the year 2016 and the tax rate was 28.3%. Profit after income taxes amounted to EUR 75.9 million and earnings per share to EUR 1.86.

Financial and asset position Due to the further reduction of working capital by roughly 13% and the good operating performance, free cash flow of EUR 109.8 million was generated and net financial liabilities were reduced from EUR 397.9 million in 2015 to EUR 332.8 million in 2016. Net financial liabilities correspond to roughly 1.8 times the EBITDA of the year 2016. The RHI Group's equity amounted to EUR 524.0 million at December 31, 2016 compared with EUR 491.4 in the previous year. The equity ratio improved from 27.2% to 29.2% in the year 2016.

Steel Division The Steel Division's sales volume rose by 4.9% from roughly 1,152,000 tons in the previous year to roughly 1,209,000 tons in the past financial year. This is primarily attributable to a significant expansion of business in the basic mixes segment, the most important segment in terms of volume. In addition to a major contract in Ukraine, the improved utilization of electric steel plants also contributed to this development. Revenue declined by 2.6% from EUR 1,099.9 million in the previous year to EUR 1,071.4 million despite the increase in sales volume, above all due to product mix effects. This is attributable to a weaker business development in South America, Europe and China and to the extension of the product portfolio by lower-performance products. Although these products support the development of sales volume and margins, they lead to lower revenue because of the lower price level. The operating EBIT improved from EUR 64.3 million in the previous year to EUR 76.2 million in the past financial year due to better utilization of the production capacities and a positive margin development in nearly all regions. It includes external costs of roughly EUR 8 million for the financial year 2016, which are related to the planned combination of RHI und Magnesita.

Industrial Division Sales volume in the Industrial Division declined by 3.4% compared with the previous year and is attributable to lower deliveries in nearly all business units. Revenue dropped by 12.4% from EUR 614.6 million in the previous year to EUR 538.6 million. In the cement/lime business unit, these reductions result from the lack of new construction projects and a declining construction industry in China, and in the glass business unit from the sale of the US subsidiary RHI Monofrax, LLC in June 2016. In the environment, energy, chemicals business unit, a major contract in the coal and petroleum coke gasifier segment in India delivered in the previous year was not compensated. The decline in revenue in the nonferrous metals business unit is based on weaker demand in the important copper and nickel segment. The operating EBIT dropped from EUR 65.0 million in 2015 to EUR 44.5 million in the past financial year due to lower deliveries and the resulting weaker utilization of production capacities. It includes external expenses of roughly EUR 4 million in the year 2016, which are related to the planned combination of RHI and Magnesita.

Raw Materials Division The Raw Materials Division's external sales volume rose significantly from roughly 297,000 tons in the previous year to roughly 342,000 tons in the past financial year. The increase by 15.2% is above all attributable to the increase in the sale of raw dolomite in Italy, which makes a large contribution in terms of volume. However, due to the low price per ton, the contribution in terms of value is minor. Revenue decreased by 2.4% from EUR 272.6 million in the previous year to EUR 266.0 million in the past financial year. The operating EBIT turned around from EUR (5.2) million to EUR 2.5 million in the past financial year, mainly because of the good capacity utilization at the two Austrian raw material plants, which predominantly produce basic mixes for the steel industry, especially for the use in electric arc furnaces. This is an immediate effect of the Steel Division's increase in sales volume in this product segment by more than 9% compared with the previous year to more than 500,000 tons.

Outlook In its forecast published in January 2017, the International Monetary Fund expects global economic growth of 3.4% in the current year after 3.1% in 2016. However, there is considerable uncertainty regarding the effects of the policies of the newly elected US government. Although the environment in the advanced economies improved in the second half of 2016, the pace of growth in the emerging markets will continue to exercise a significant influence on the global economic situation. Based on a study of mid-November 2016, the research institute CRU expects steel production in China to decline by roughly 2% in the year 2017 and steel production outside China to grow by an ambitious 6%. The emerging markets are also among the main drivers in this area. Based on these estimates, RHI expects a more positive market environment in 2017. The focus will stay on the generation of free cash flow in the current financial year in order to reduce net debt further. RHI is currently working on meeting the conditions precedent to the successful closing of the planned combination with Magnesita and is preparing the integration of the two companies. In the context of these activities, external costs will be incurred. The Management Board of RHI AG intends to propose a dividend of EUR 0.75 per share to the Annual General Meeting on May 5, 2017, the same as in the previous year.

Preliminary Key Figures 2016

2016 2015 Delta 4Q/16 4Q/15 Delta Sales volume (thousand tons) 1,979 1,892 4.6% 511 488 4.7% Steel Division 1,209 1,152 4.9% 300 269 11.5% Industrial Division 428 443 (3.4)% 131 136 (3.7)% Raw Materials Division 342 297 15.2% 80 83 (3.6)%

in EUR million Revenues 1,651.2 1,752.5 (5.8)% 423.9 440.0 (3.7)% Steel Division 1,071.4 1,099.9 (2.6)% 268.2 257.8 4.0% Industrial Division 538.6 614.6 (12.4)% 145.1 171.2 (15.2)% Raw Materials Division External revenues 41.2 38.0 8.4% 10.6 11.0 (3.6)% Internal revenues 224.8 234.6 (4.2)% 51.7 49.9 3.6% EBITDA 189.1 140.0 35.1% 40.4 (2.3) 1,856.5% EBITDA margin 11.5% 8.0% 3.5pp 9.5% (0.5)% 10.0pp Operating EBIT 1) 123.2 124.1 (0.7)% 25.2 32.7 (22.9)% Steel Division 76.2 64.3 18.5% 13.1 13.6 (3.7)% Industrial Division 44.5 65.0 (31.5)% 13.9 24.3 (42.8)% Raw Materials Division 2.5 (5.2) 148.1% (1.8) (5.2) 65.4% Operating EBIT margin 7.5% 7.1% 0.4pp 5.9% 7.4% (1.5)pp Steel Division 7.1% 5.8% 1.3pp 4.9% 5.3% (0.4)pp Industrial Division 8.3% 10.6% (2.3)pp 9.6% 14.2% (4.6)pp Raw Materials Division 2) 0.9% (1.9)% 2.8pp (2.9)% (8.5)% 5.6pp EBIT 116.1 37.5 209.6% 15.0 (53.9) 127.8% Steel Division 76.3 63.4 20.3% 13.2 12.7 3.9% Industrial Division 32.0 58.9 (45.7)% 6.0 18.2 (67.0)% Raw Materials Division 7.8 (84.8) 109.2% (4.2) (84.8) 95.0% EBIT margin 7.0% 2.1% 4.9pp 3.5% (12.3)% 15.8pp Steel Division 7.1% 5.8% 1.3pp 4.9% 4.9% 0.0pp Industrial Division 5.9% 9.6% (3.7)pp 4.1% 10.6% (6.5)pp Raw Materials Division 2) 2.9% (31.1)% 34.0pp (6.7)% (139.2)% 132.5pp Net finance costs (21.2) (19.3) (9.8)% (4.7) (3.3) (42.4)% Share of profit of joint ventures 10.9 9.2 18.5% 3.5 2.5 40.0% Profit before income tax 105.8 27.4 286.1% 13.8 (54.7) 125.2% Income taxes (29.9) (9.8) (205.1)% (1.9) 16.3 (111.7)% Income taxes in % 28.3% 35.8% (7.5)pp 13.8% 29.8% (16.0)pp Profit for the year 75.9 17.6 331.3% 11.9 (38.4) 131.0%

Earnings per share in EUR 3) 1.86 0.40 0.29 (0.98)

1) EBIT before losses of derivatives from supply contracts, impairment losses and restructuring effects 2) based on internal and external revenues 3) basic and diluted

Preliminary key figures (in EUR million) 2016 2015 Delta

Balance sheet total 1,792.2 1,804.5 (0.7)% Equity 524.0 491.4 6.6% Equity ratio (in %) 29.2% 27.2% 2.0pp

Investments in PP&E and intangible assets 70.8 80.8 (12.8)%

Net debt 332.8 397.9 (16.4)% Gearing ratio (in %) 63.5% 81.0% (17.5)pp Net debt / EBITDA 1.8 2.8 (1.0) Working capital 465.1 532.6 (12.7)% Working capital (in %) 28.2% 30.4% (2.2)pp Capital employed 1,095.8 1,176.5 (6.9)%

Return on average capital employed (in %) 7.6% 2.3% 5.3pp Net cash flow from operating activities 162.7 175.4 (7.2)% Net cash flow from investing activities (52.9) (47.2) (12.1)% Net cash flow from financing activities (80.7) (124.4) 35.1%

Gearing ratio: net debt / equity Working Capital: Inventories + Trade receivables and receivables from long-term construction contracts - Trade payables - Prepayments received Capital Employed: Property, plant and equipment + Goodwill + Other intangible assets + Working Capital Return on average capital employed: (EBIT - Taxes) / average Capital Employed

end of announcement euro adhoc

company: RHI AG Wienerbergstrasse 9 A-1100 Wien phone: +43 (0)50213-6676 FAX: +43 (0)50213-6130 mail: rhi@rhi-ag.com WWW: http://www.rhi-ag.com sector: Refractories ISIN: AT0000676903 indexes: ATX Prime, ATX stockmarkets: official market: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/1644/aom

Wiener Börse Party #1098: ATX nach Rekord etwas leichter, Bawag und Semperit gesucht, die dichteste News-Lage gibt es heute bei Strabag

RHI Letzter SK: 0.00 ( 0.00%)

Bildnachweis

1.

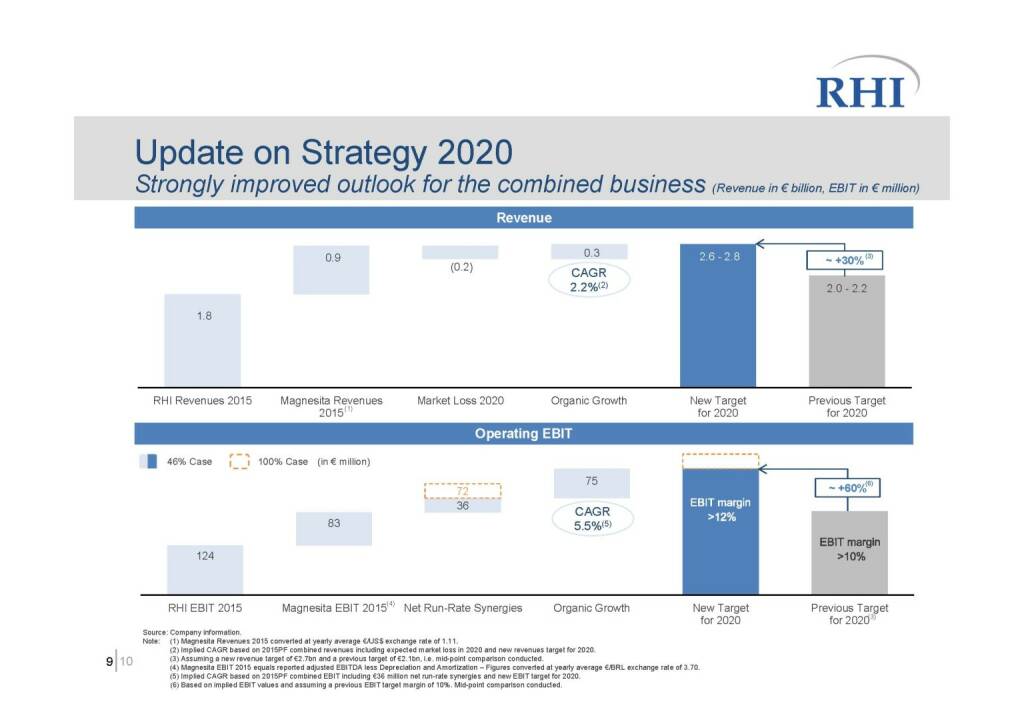

RHI - Update on Strategy 2020

>> Öffnen auf photaq.com

Aktien auf dem Radar:Kapsch TrafficCom, Agrana, DO&CO, Bajaj Mobility AG, Polytec Group, CPI Europe AG, Amag, Uniqa, ATX, ATX Prime, ATX TR, Bawag, Rosgix, ATX NTR, AT&S, Erste Group, VIG, Semperit, Gurktaler AG VZ, SBO, Stadlauer Malzfabrik AG, voestalpine, Wienerberger, RHI Magnesita, BKS Bank Stamm, Athos Immobilien, Reploid Group AG, Oberbank AG Stamm, Josef Manner & Comp. AG, CA Immo, EuroTeleSites AG.

Random Partner

DenizBank AG

Die DenizBank AG wurde 1996 gegründet und ist eine österreichische Universalbank. Sie unterliegt dem österreichischen Bankwesengesetz und ist Mitglied bei der gesetzlichen einheitlichen Sicherungseinrichtung der Einlagensicherung AUSTRIA GmbH. Die DenizBank AG ist Teil der türkischen DenizBank Financial Services Group, die sich seit 2019 im Besitz der Emirates NBD Gruppe befindet.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Österreich-Depots: Knapp unter Rekord (Depot Komm...

- Wiener Börse Party #1098: ATX nach Rekord etwas l...

- Börsegeschichte 19.2.: Extremes zu EVN und Marino...

- Nachlese: Es ist sich noch ein neuer ATX-Rekord a...

- Wiener Börse zu Mittag nach Rekord schwächer: Baw...

- #gabb Jobrradar: Uniqa, DO & CO, wienerberger (#g...

Featured Partner Video

Wiener Börse Party #1096: ATX leichter, Telekom Austria erstmals seit Mai 2025 über 10 Euro, Bawag x MSCI, AT&S x Oddo BHF

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse. Inh...

Books josefchladek.com

Moderne Architektur

1902

Anton Schroll

zooreal

2003

Kontrast Verlag

As Long as the Sun Lasts

2025

Void

Photographie n'est pas L'Art

1937

GLM

Das Neue Haus

1941

Verlag Dr. H. Girsberger & Cie

Matteo Girola

Matteo Girola Ray K. Metzker

Ray K. Metzker  Pia Paulina Guilmoth & Jesse Bull Saffire

Pia Paulina Guilmoth & Jesse Bull Saffire Raymond Thompson Jr

Raymond Thompson Jr