31.07.2019, 7095 Zeichen

- ECB prepares new steps to provide additional monetary stimulus (lower deposit rate, QE).

- Medium-term inflation outlook is no longer in line with ECB’s inflation aim and deterioration of inflation expectations has become more evident.

- Moderate EA growth endures and risks remain tilted to the downside as uncertainties prolong.

The European Central Bank (ECB) has stopped its monetary policy normalization and went into reverse before interest rates have even been raised once. Last week’s meeting has brought substantial changes to the central bank’s communication, strongly indicating additional easing measures to be introduced in September, the ECB’s next Governing Council meeting. A lowering of the deposit facility rate, currently at -0.4 %, alongside changes to the forward guidance on policy rates are likely and the launch of a new asset purchase program (QE) cannot be ruled out. The Governing Council has underlined “the need for a highly accommodative stance of monetary policy for a prolonged period of time”. The change of course responds to prolonged uncertainty in the economic outlook and inflation running persistently below the ECB’s inflation target alongside a recent deterioration of inflation expectations.

Among the many changes to the ECB’s communication was an adjustment to the forward guidance on policy rates. The Government Council added an easing bias opening the way for lowering interest rates in September. The ECB now expects “interest rates to remain at their present or lower levels at least through the first half of 2020”. The date dependency has already been altered twice after having been introduced in June 2018, when the Governing Council expected interest rates to remain at their present levels “at least through the summer of 2019”. In March 2019 the date dependency was then shifted to the end of the year and has further been postponed to the first half of 2020 in June. Financial market expectations of the path of short-term ECB interest rates have responded accordingly by postponing the date of a possible rate hike. Figure 1 shows expected future short-term rates as of January 2018, July 2018, December 2018 and July 2019 based on 1-month overnight index swap (OIS) forwards. Most recently financial markets expect ECB interest rates to remain at or below their present levels until 2024. In early 2018, it was believed that a similar level of interest rates will already be reached by mid-2019.

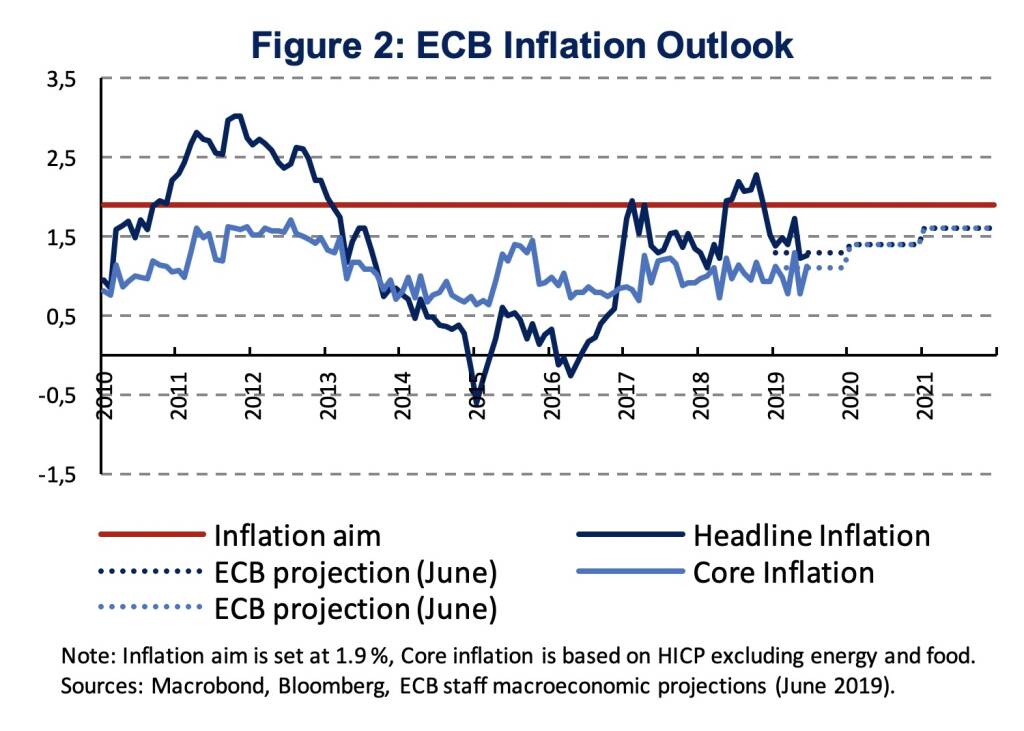

Consistent with expectations of low monetary policy interest rates, the Governing Council stressed the “need for a highly accommodative stance of monetary policy for a prolonged period of time”. Further, the ECB emphasized its determination to act “if the medium-term inflation outlook continues to fall short of its aim”. Most recent ECB projections (June) show Euro Area inflation at 1.3 % in 2019 and 1.6 % in 2021. A new set of ECB staff macroeconomic projections will be released in September. Until now, however, there is little evidence why the inflation outlook would have improved, as current readings seem to be in line with the most recent outlook. Headline inflation was 1.3 % in June, while core inflation, a better proxy for the underlying inflation trend, was 1.1 %. The ECB’s inflation aim is below but close to 2 % over the medium term, which “in a sense is 1.9 %” according the Mario Draghi. What was new in last week’s statement is the focus on symmetry. Symmetry means that there is no 2 % cap such that inflation can deviate on both sides. A short-term overshooting of inflation, therefore, does not require an immediate tightening of monetary policy.

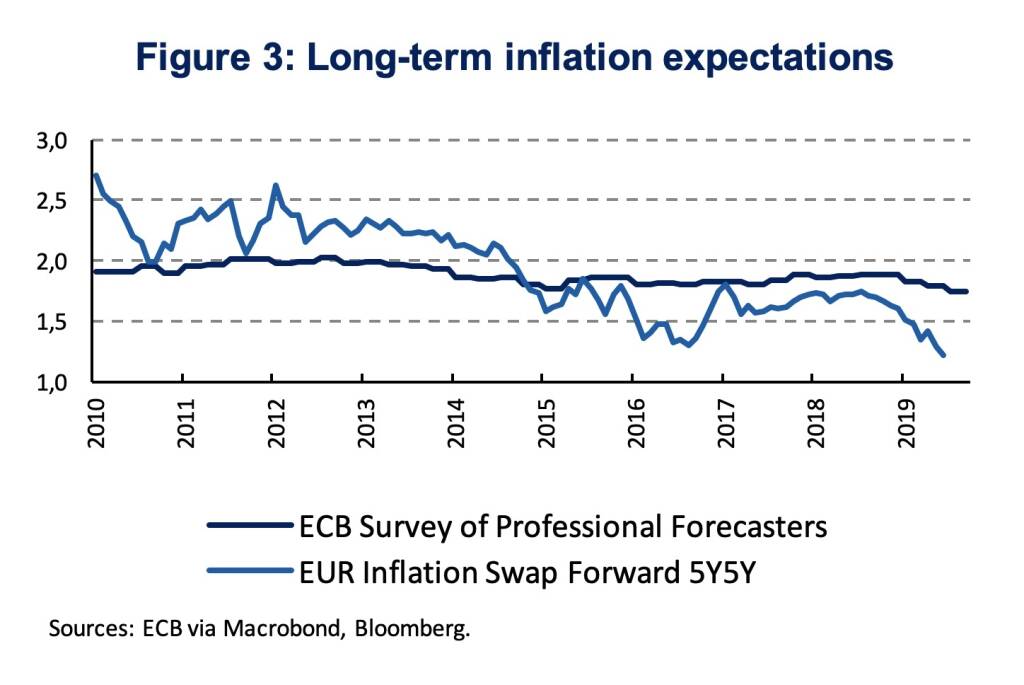

A main driver of the medium-term inflation outlook is expected inflation. As long as firms’ and households’ expectations of future inflation remain at the ECB’s inflation target, a sustained convergence to the central bank’s aim is likely over the medium term. Hence, inflation expectations are among the key indicators of the Governing Council’s watch list. The recent deterioration of inflation expectations should, therefore, not be underestimated in driving the Governing Council’s decision to provide additional monetary policy accommodation. The development of inflation expectations can be assessed by looking at market- as well as survey-based measures. The most common long-term market-based inflation expectation measure is the five-year forward inflation-linked swap rate five years ahead, while the ECB’s survey of professional forecasters (SPF) provides a survey-based indication (Figure 3). The drop of inflation expectations has been more pronounced according to market-based measures. Survey-based inflation expectations are less volatile and have remained closer to the ECB’s inflation target. In a recent speech Benoît Cœuré, Member of the Executive Board of the ECB, has argued that market-based inflation expectations are more consistent with survey-based measures once being corrected for changes in the inflation risk premium [1]. In Q3, however, also the ECB’s SPF shows long-term inflation expectation at its lowest level (1.7 %) providing more consistent evidence of an overall drop in inflation expectations.

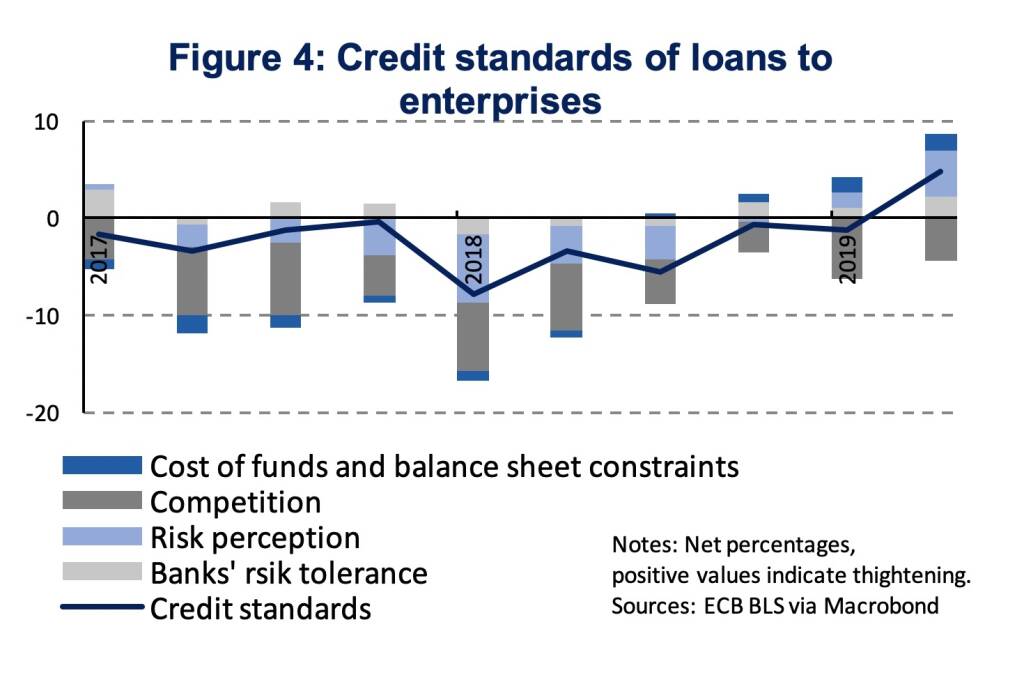

In spite of continued extensive monetary policy accommodation credit standards for loans to enterprises have tightened in the second quarter of 2019, as shown by the Euro Area most recent bank lending survey. A phase of easing credit standards has started in early 2014 with only one quarter of tightening. In Q2 credit standard tightening was predominantly driven by concerns about the economic outlook (risk perception, Figure 4), competition is easing credit standards. Demand for loans, yet, remains strong both for loans to enterprises and households.

Risks surrounding the Euro Area growth outlook remain tilted to the downside and a rebound in H2 2019, as previously anticipated by the ECB, has become more unlikely. Economic growth was surprisingly strong during the first quarter of the year, when the Euro Area economy expanded by 0.4 % (quarter-on-quarter, seasonally adjusted), yet, signs of a slowing expansion continue to weigh on the outlook. Our Nowcasting model, which predicts quarterly GDP growth based on high frequency business cycle indicators, indicates 0.2 % quarter-on-quarter growth in Q2 2019. Preliminary figures will be released on Wednesday (31.07).

In light of only moderate economic growth, projected medium-term inflation below the central bank’s aim and deteriorating long-term inflation expectations, the ECB has tasked its staff to examine options to provide additional monetary policy stimulus. The focus is laid on reinforcing the ECB’s forward guidance on policy rates, design mitigating measures for lowering the deposit rate and provide options for the size and composition of potential new net asset purchases. Details can be expected by September.

[1] Inflation expectations and the conduct of monetary policy, Speech by Benoît Cœuré, SAFE Policy Center, Frankfurt am Main, 11 July 2019.

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Wiener Börse Party #1068: ATX leicht fester, warum die Post zu erwähnen ist, Mostböck & Co. mit guten Infos, Drastil als Augenmedizin-Model

Bildnachweis

1.

Expectations of short-term rates

2.

ECB Inflation Outlook

3.

Long-term inflation expectations

4.

Credit standards of loans to enterprises

5.

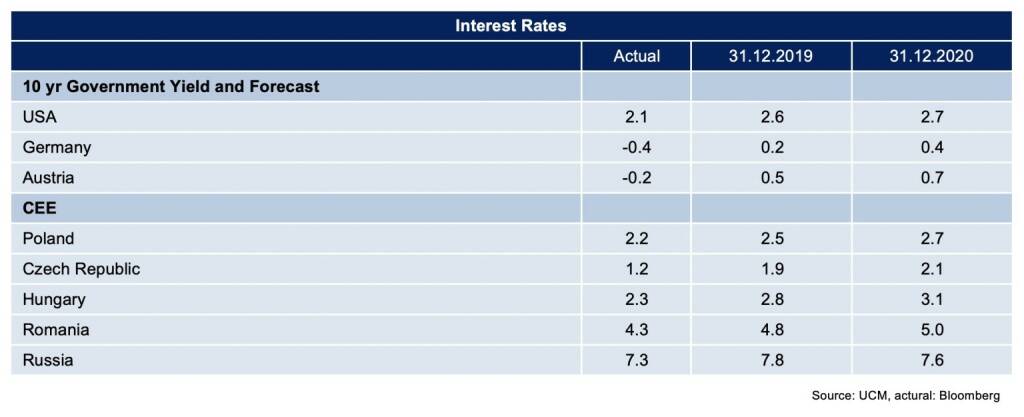

Interest rates

Aktien auf dem Radar:Austriacard Holdings AG, Addiko Bank, Agrana, Rosgix, Österreichische Post, Warimpex, Flughafen Wien, AT&S, FACC, Frauenthal, Frequentis, Semperit, SW Umwelttechnik, UBM, CA Immo, Zumtobel, EuroTeleSites AG, Kapsch TrafficCom, Rosenbauer, Oberbank AG Stamm, BKS Bank Stamm, Josef Manner & Comp. AG, Marinomed Biotech, Amag, Polytec Group, Verbund.

Random Partner

Uniqa

Die Uniqa Group ist eine führende Versicherungsgruppe, die in Österreich und Zentral- und Osteuropa tätig ist. Die Gruppe ist mit ihren mehr als 20.000 Mitarbeitern und rund 40 Gesellschaften in 18 Ländern vor Ort und hat mehr als 10 Millionen Kunden.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Wiener Börse Party #1068: ATX leicht fester, warum die Post zu erwähnen ...

» LinkedIn-NL: Heute wurde ich überrascht: Irre Reise 1985 bis zum Wahnsin...

» Österreich-Depots: Verbund läuft (Depot Kommentar)

» Börsegeschichte 7.1.: Wolfgang Eder, Pierer Mobility (Börse Geschichte) ...

» Nachlese: Michael Lielacher, Barbara Potisk-Eibensteiner, Christian Dras...

» Wiener Börse zu Mittag schwächer: UBM, Austriacard und Frequentis gesucht

» Wiener Börse zu Mittag schwächer: UBM, Austriacard und Frequentis gesucht

» PIR-News: News zu EVN, UBM, Top 10 der wertvollsten Börsennotierten (Chr...

» ATX-Trends: CPI, CA Immo, VIG, Verbund ...

» Wiener Börse Party #1067: ATX leicht im Minus; AT&S-Serie hält, weiter f...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wiener Börse Party #1068: ATX leicht fester, waru...

- Wiener Börse: ATX beendet Donnerstag-Handel doch ...

- Wiener Börse Nebenwerte-Blick: UBM als Tagesgewinner

- Wie UBM, Warimpex, Frequentis, Semperit, Frauenth...

- Wie AT&S, DO&CO, Lenzing, CPI Europe AG, Uniqa un...

- LinkedIn-NL: Heute wurde ich überrascht: Irre Rei...

Featured Partner Video

kapitalmarkt-stimme.at daily voice: ATX TR zum 35er heute mit schnellstem 1000er-Marken-Sprung ever und der WBI ist über 2000!

Mitte November ging der ATX TR über 12.000 Punkte, heute zum 35er des rückgerechneten Starts schon erstmals über 13.000. Der schnellste Runde-Marke-Sprung in der Geschichte. Und der WBI, der ist be...

Books josefchladek.com

Heustock

2025

Verlag der Buchhandlung Walther König

What if Jeff were a Butterfly?

2025

Void

Il senso della presenza

2025

Self published

Anna Fabricius

Anna Fabricius Adriano Zanni

Adriano Zanni Thonet

Thonet Erich Einhorn

Erich Einhorn Marjolein Martinot

Marjolein Martinot