17.12.2018, 6930 Zeichen

- Exit from QE has been confirmed, reinvestment of accumulated stock continues to provide accommodative monetary conditions.

- The December macro projections include downward revisions in GDP growth and inflation.

- Redemptions will be reinvested past the first increase in key interest rates. New ECB capital keys requires portfolio reallocation.

In the meeting of the governing council (GC) last Thursday, the ECB confirmed its exit from ultra-loose monetary policy or quantitative easing (QE). Net asset purchases under the asset purchase program (APP) will end by December. The accumulated stock of assets will, however, be reinvested, in full, for an extended period of time and past the date when the GC starts raising key interest rates. This was not unexpected as the US Federal Reserve has only started to reduce its balance sheet in October 2017, which was almost two years after the first interest rate hike in December 2015. Hence, even after the ECB initiates an interest rate hiking cycle, earliest in autumn 2019, the stock of accumulated assets will provide an ample degree of monetary accommodation. This is also known the stock effect.

The Euro Area business cycle has recently shown signs of a slowdown after a period of solid economic expansion. In Q3 2018, real GDP increased by meagre 0.2 % (q/q) The expenditure details revealed slow growth in household consumption (+0.1 %) and fixed investment (+0.2 %) and a quarterly decline in exports ( -0.1 %). Risk surrounding the Euro Area growth outlook can still be assessed as broadly balanced, according to the GC. However, President Draghi noted that “the balance of risks is moving to the downside owing to the persistence of uncertainties related to geopolitical factors, vulnerabilities in emerging markets and financial market volatility”. The December staff macroeconomic projections were released last week. Projections for GDP growth and inflation were revised downward compared to the September forecast. Real GDP is expected to grow by 1.9 %, 1.7 %, 1.7 % and 1.5 % between 2018 and 2021 (September: 2.0 %, 1.8 % and 1.7 % between 2018-2020). On a quarterly basis, the ECB expects GDP to rise by 0.4 % in Q4 2018 and 0.5 %, 0.5 %, 0.5 % and 0.4 % during Q1 to Q4 2019. Hence, the projection implies a rebound in quarterly growth momentum after a temporary slowdown during the second half of 2018.

HICP inflation is projected at 1.8 %, 1.6 %, 1.7 % and 1.8 % (September: 1.7 %, 1.7 % and 1.7 % in 2018-20). Core inflation (excluding energy and food prices) is expected to increase gradually by 1.0 %, 1.4 %, 1.6 % and 1.8 % (2018-21), while in September the ECB had projected core inflation of 1.1 %, 1.5 % and 1.8 % (2018-20). Hence, it is anticipated that it will take one more year until the inflation rate converges towards the central bank’s target below but close to 2 % (Figure 1).

Besides the more explicit forward guidance on reinvestment provided by the GC’s statement, the ECB has published a note on the technical parameters for reinvestment to provide further details. First, the accumulated stock of assets will be maintained under each constituent program. The composition of the asset purchase program, which consists of a public-sector purchase program (PSPP), an asset-backed securities purchase program (ABSPP), a covered bond purchase program (CBPP3) and a corporate sector purchase program (CSPP), will not change. Second, within the public-sector purchase program (PSPP) the allocation will continue to be guided by the national central banks’ subscription to the ECB capital key. This holds on a stock basis, such that the country shares of accumulated assets under the PSPP should correspond to the capital keys, adjusted for country participation in the PSPP.

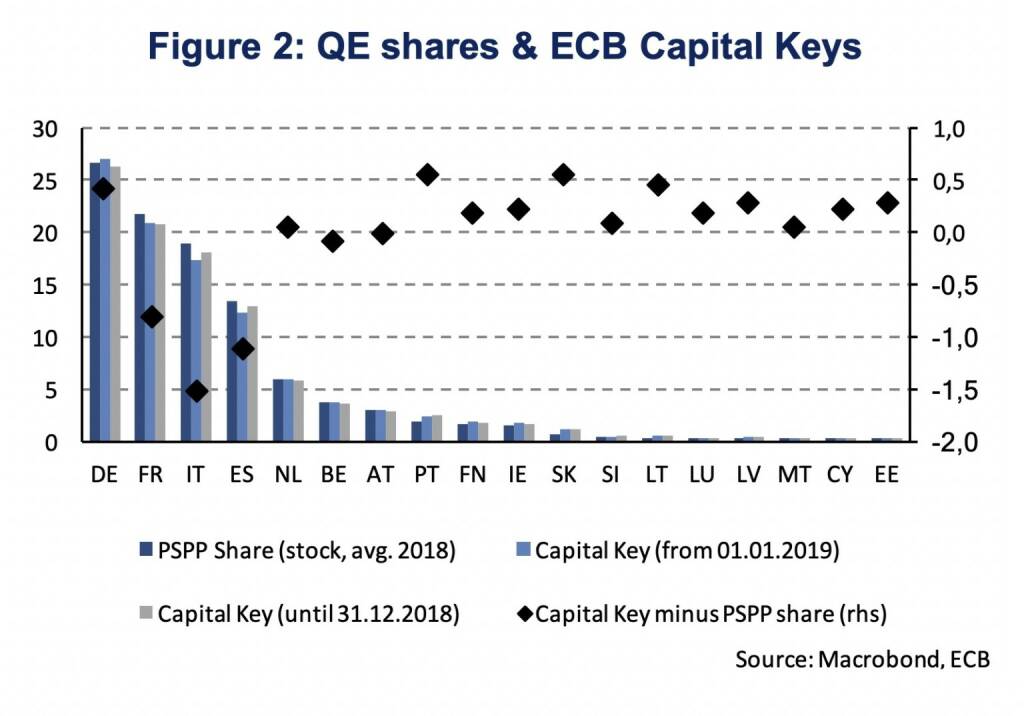

Capital keys, however, are not fixed as they reflect a country’s share in the total population and gross domestic product of the EU, with equal weighting. New capital keys will become effective from the 1st January of 2019 onwards. Germany will face the largest percentage-point increase in its capital key (18 % to 18.4 %) while Spain (8.8 % to 8.3 %) and Italy (12.3 % to 11.8 %) will face the largest declines. In order to compare capital keys to the respective country shares in the PSPP, they need to be adjusted for Euro-Area membership and exclude Greece which has no participation in the PSPP. Figure 2 shows PSPP shares, adjusted capital keys on the left axis and the respective percentage point difference between the capital key and the PSPP share on the right axis. It can be seen that Italy (-1.5 %-age points), Spain (-1.1 %-age points) and France (-0.8 %-age points) face the largest negative difference between the PSPP share and the country’s respective capital key. Portugal, Slovakia (0.6 %-age points each) and Germany (0.4 %-age points) show the largest positive difference. Countries with a positive (negative) difference need to have a larger (smaller) allocation from reinvestment to bring the PSPP share in line with the capital key. As the capital key is partly determined by relative GDP, countries with lower GDP growth will also face a fall in demand from the PSPP.

The alignment of PSPP shares to capital keys will be gradual and done by reinvestments of the ECB rather than national central banks. The guidelines state that “redemptions will be reinvested in the jurisdiction in which principal repayments are made, but the portfolio allocation across jurisdiction will continues to be adjusted with a view to bringing the share of the PSPP portfolio into closer alignment with respective national central banks’ subscriptions to the ECB capital key.” From April 2016 onwards 10 % of monthly PSPP purchases (excluding supranational bonds) have been conducted by the ECB (8 % before April 2016) [1]. Redemption from these assets, which were accumulated via the risk-shared part of the PSPP, can now be reinvested to align PSPP shares to capital keys. The alignment will be gradual.

Despite the weaker growth outlook, QE ends (as was widely expected) and no new/additional monetary stimulus is yet provided. The new growth outlook hinges on a gradual rebound in quarterly growth momentum over the next months, while, for example, our own nowcast model keeps indicating a milder GDP growth rate until year-end (0.3 % q/q). The key ECB interest rates are expected to remain at their present levels at least through the summer 2019. The ECB stated more explicitly that an ample degree of monetary stimulus remains in place through reinvestment of maturing securities past the date when an interest rate hiking cycle starts. Future reinvestment from redemptions will gradually align PSPP shares to capital keys.

[1] Public sector purchase programme (PSPP)- Questions & Answers (https://www.ecb.europa.eu/mopo/implement/omt/html/pspp-q...

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

BörseGeschichte Podcast: Herbert Ortner vor 10 Jahren zum ATX-25er

Bildnachweis

1.

ECB staff inflation forecast

2.

QE shares & ECB Capital Keys

3.

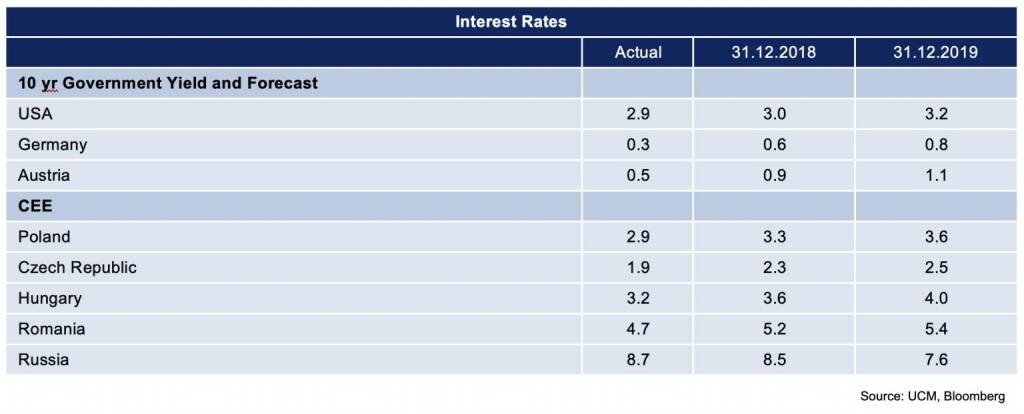

Interest Rates

Aktien auf dem Radar:Austriacard Holdings AG, Addiko Bank, Agrana, Rosgix, Österreichische Post, Warimpex, Flughafen Wien, AT&S, FACC, Frauenthal, Frequentis, Semperit, SW Umwelttechnik, UBM, CA Immo, Zumtobel, EuroTeleSites AG, Kapsch TrafficCom, Rosenbauer, Oberbank AG Stamm, BKS Bank Stamm, Josef Manner & Comp. AG, Marinomed Biotech, Amag, Polytec Group, Verbund, Airbus Group, Merck KGaA, Vonovia SE, Siemens Healthineers, Fresenius Medical Care.

Random Partner

Wiener Privatbank

Die Wiener Privatbank ist eine unabhängige, unternehmerisch handelnde Privatbank mit Sitz in Wien.

Als börsennotiertes Unternehmen steht die Bank für Transparenz und verfügt über eine äußerst solide finanzielle Basis. Zu den Kundinnen und Kunden zählen Family Offices, PrivatinvestorInnen, Institutionen sowie Stiftungen im In- und Ausland.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Börse-Inputs auf Spotify zu u.a. Viktoria Gass PwC, Herbert Ortner

» Börsepeople im Podcast S22/24: Viktoria Gass

» ATX-Trends: AT&S, wienerberger, Frequentis ...

» Wiener Börse Party #1068: ATX leicht fester, warum die Post zu erwähnen ...

» LinkedIn-NL: Heute wurde ich überrascht: Irre Reise 1985 bis zum Wahnsin...

» Österreich-Depots: Verbund läuft (Depot Kommentar)

» Börsegeschichte 7.1.: Wolfgang Eder, Pierer Mobility (Börse Geschichte) ...

» Nachlese: Michael Lielacher, Barbara Potisk-Eibensteiner, Christian Dras...

» Wiener Börse zu Mittag schwächer: UBM, Austriacard und Frequentis gesucht

» Wiener Börse zu Mittag schwächer: UBM, Austriacard und Frequentis gesucht

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Börse-Inputs auf Spotify zu u.a. Viktoria Gass Pw...

- DAX-Frühmover: Scout24, BMW, Siemens Energy, Hann...

- BayWa, Aixtron am besten (Peer Group Watch Deutsc...

- Research-Fazits zu Porsche, FlatexDegiro, Deutsch...

- Börsepeople im Podcast S22/24: Viktoria Gass

- Guten Morgen mit SFC Energy, MTU, TeamViewer, Gle...

Featured Partner Video

kapitalmarkt-stimme.at daily voice: Der ATX Five hinkt weiterhin brutal hinterher, hat aber - relativ zum ATX - auch kein Aufholpotenzial

kapitalmarkt-stimme.at daily voice auf audio-cd.at: Bis auf den ATX Five, der noch 20 Prozent von seinen Hochs entfernt ist, sind alle relevanten Austro-Indices auf High. Hat der ATX Five deshalb A...

Books josefchladek.com

Il senso della presenza

2025

Self published

Das Neue Haus

1941

Verlag Dr. H. Girsberger & Cie

Flatlands

2023

Hartmann Projects

Heustock

2025

Verlag der Buchhandlung Walther König

JH Engström

JH Engström Jeff Mermelstein

Jeff Mermelstein Marjolein Martinot

Marjolein Martinot Claudia Andujar

Claudia Andujar