20.05.2019, 6822 Zeichen

- While the global and Euro Area business cycles slow, the economic expansion remains surprisingly strong in CEE.

- The region shows a high degree of economic integration with the Euro Area, yet strong domestic demand more than compensates for the weakening external conditions.

- Improvements in labor markets have been broad based and rising wages support household consumption as, so far, inflation remains rather muted.

- The region’s strong growth performance drives economic convergence. For it to persist, digital capacities will be essential to close the gap to an evolving technological frontier.

Central and Eastern Europe (CEE) maintains a solid expansion albeit a weakening external macroeconomic environment. The expansion of the global economy has slowed to 3.6 % in 2018 after 3.8 % in 2017 and the growth outlook for 2019 has further been lowered to 3.3 % (OECD, IMF). Business sentiment has deteriorated continuously throughout the year which can further be linked to elevated levels of political uncertainty. Trade tensions between the United States and China heightened and the future EU-UK relationship remains unclear. Among developed economies, the growth slow-down was markedly felt in the Euro Area. The European Central Bank (ECB) has revised its 2019 GDP growth projection downward since mid-2018 (Figure 1). The latest ECB staff macroeconomic projections from March indicate Euro Area GDP growth at 1.1 % in 2019. The preliminary estimate of first quarter GDP growth at 0.4 % (quarter-on-quarter, seasonally adjusted), which has been released at the end of April, shows a mild gain in economic momentum compared to the second half of 2018.

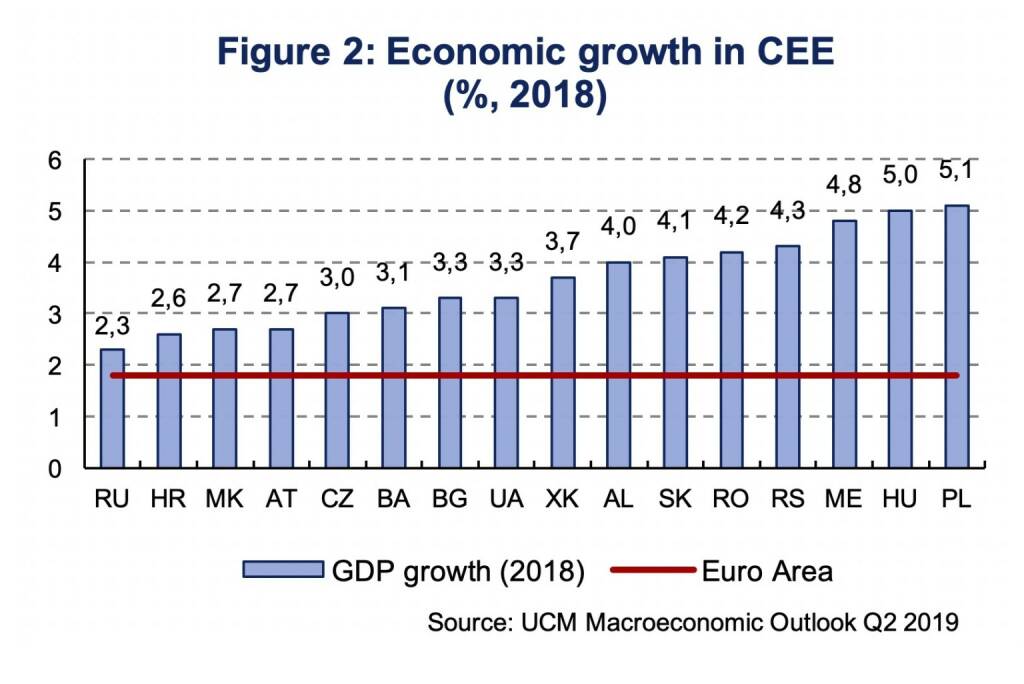

While Euro Area growth slowed to 1.8 % in 2018 (2017: 2.5 %), the CEE economies, in which UNIQA operates, expanded by 3.3 % (2017: 3.0 %). Excluding Russia, our preferred aggregate, GDP growth of the region was 4.2 %. In the years ahead, we expect growth to remain solid, yet to gradually slow down (2019: 3.5 %, 2020: 3.3 %). In every single CEE economy GDP growth was above the Euro Area average, from 2.3 % in Russia to 5.1 % in Poland (Figure 2). Moreover, our real-time GDP trackers for Central Europe indicate continued growth momentum. Hence, the region’s resilience to weaker Euro Area growth is set to continue with CEE as Europe’s engine of growth.

In spite of the region’s resilience, the economies of CEE remain closely integrated into Euro Area value chains. In the Czech Republic, for instance, 55 % of domestic gross value added in exports is exported to Euro Area countries, 24.4 % to Germany alone. Among the top 10 countries with the highest Euro Area export share, in gross valued added terms, are 6 countries located within the CEE region (Table 1). Hence, if the weakness of the Euro Area business cycle endures for longer, the region will not be immune to negative spill-overs.

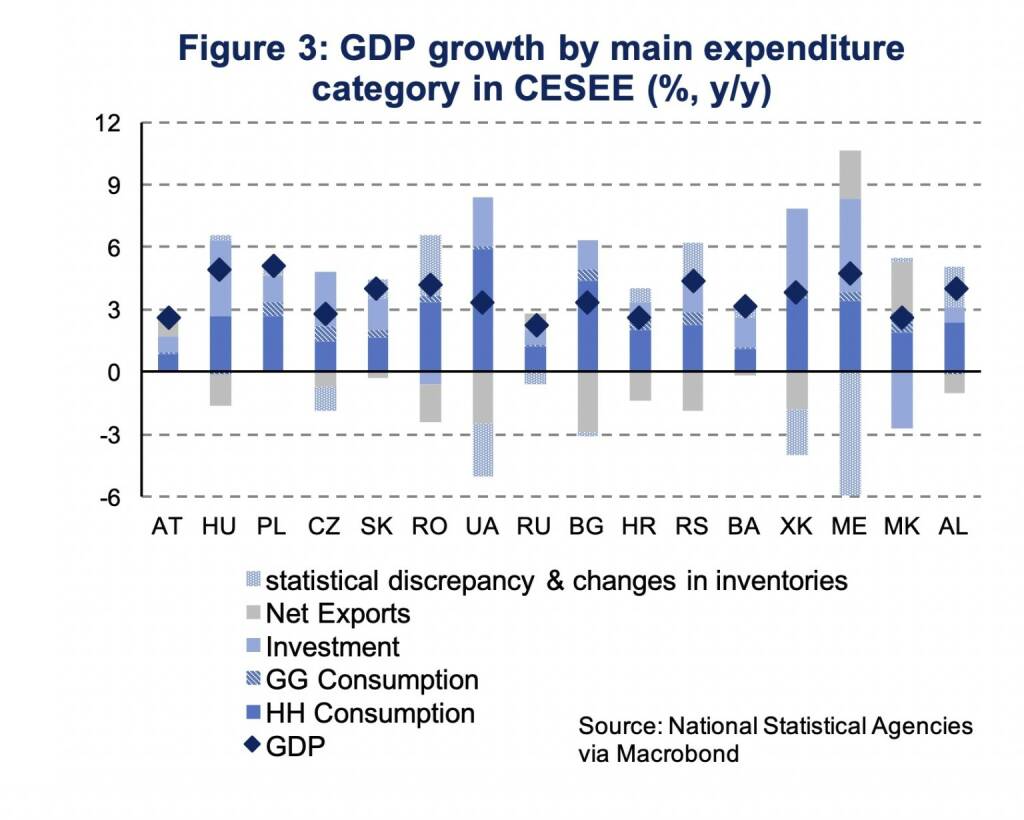

So far negative effects from weaker external demand have been more than compensated by a boost in domestic demand. The structure of GDP growth in many CEE economies has increasingly shifted towards household consumption as well as investment activity. Net-exports, on the other hand, have subtracted from GDP growth in 2018, not in Montenegro and North Macedonia though (Figure 3).

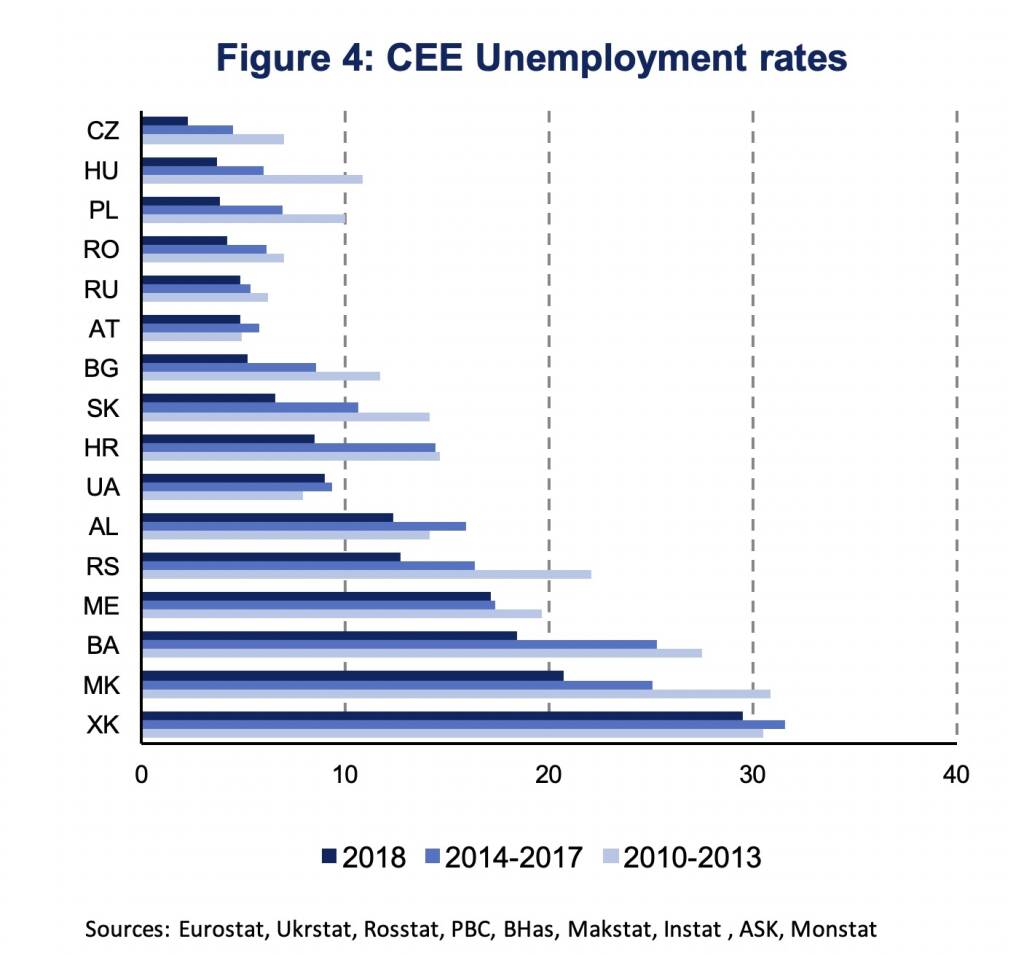

Improvements in CEE labor markets have substantially contributed to the region’s resilience. In 2018, unemployment rates have been substantially lower than in previous periods, with the exception of Ukraine where the unemployment rate increased until 2017. Yet, labor markets continue to be heterogeneous. Unemployment rates range from 2.2 % in the Czech Republic to almost 29.5 % in Kosovo. They tend to be lower in European Union member states and higher at the Western Balkan (Figure 4).

In spite of tightening labor markets, inflationary pressure has remained rather dampened. In most CEE economies inflation is at historically low levels and at, or below, the respective central banks’ inflation targets (Figure 5). Yet, wage growth has accelerated quite substantially in a number of CEE economies, like Ukraine, Romania and Hungary, where inflationary pressure have increased lately.

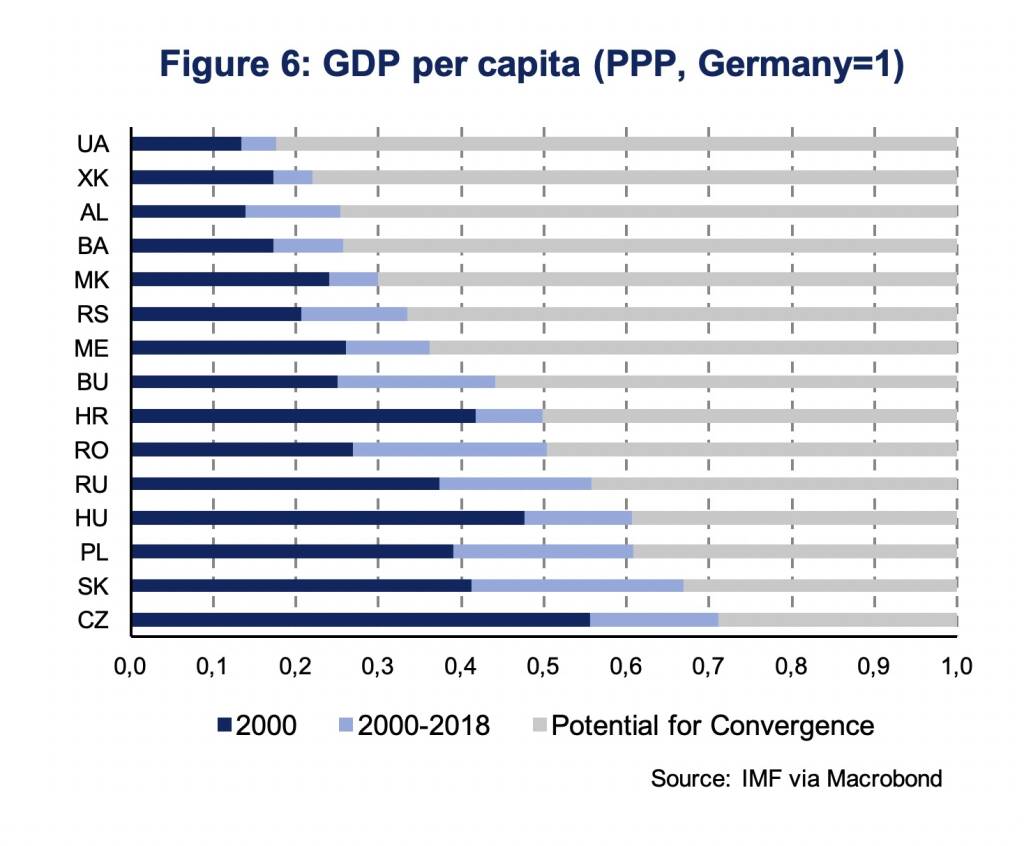

The strong business cycle has ensured economic convergence to continue. CEE economies, particularly those which have already been part of the EU, have fueled European convergence prior to the Great Recession of 2008/09. After the crisis, convergence has continued, yet, at a slower pace. Since 2000 the average EU-CEE economy has close the GDP per capita gap to Germany by 20 %-age points. Poland, for instance, had a GDP per capita of 39 % the German level in 2000, compared to 61 % in 2018 (Figure 6). Countries at the Western Balkan were less successful. Ukraine has closed the gap to Germany by 4 %, even though starting at a much lower level (13 %) than Poland. This shows that there is no guarantee for convergence. Convergence is conditional on, so called, social capacities which are vital for technological progress to diffuse. The quality of national institutions as well as a labor force equipped with the necessary skills are among the best validated examples.

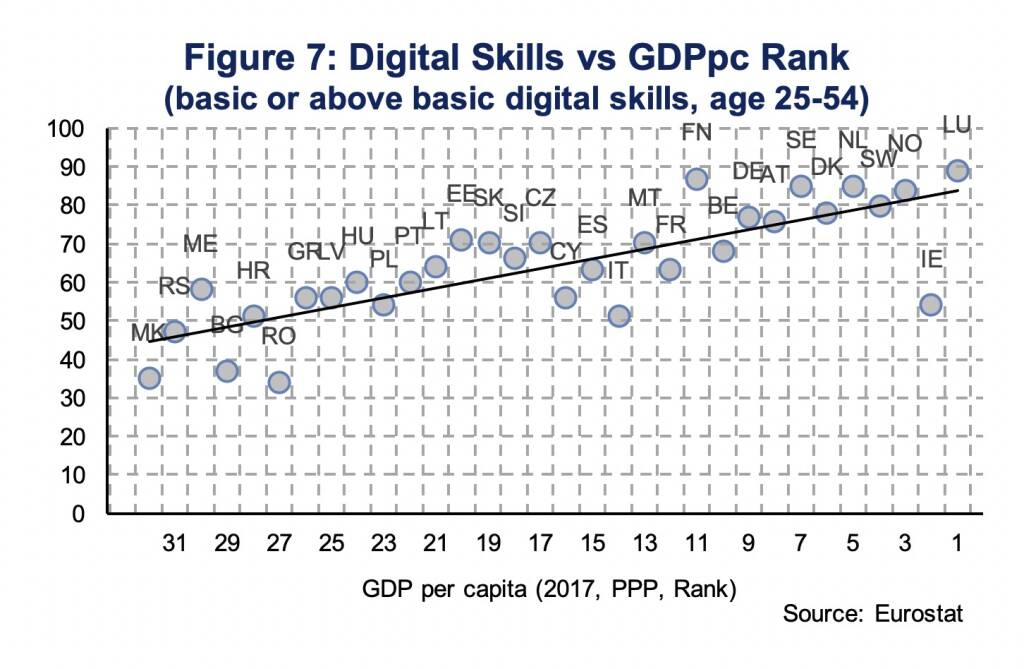

Looking ahead, the innovative capacity with respect to digital technologies and processes will be vital to converge. Comparing digital skills of the labor force (age 25-54) with a country’s rank of GDP per capita, gives a descriptive indication with respect to the potential of convergence based on digital technologies (Figure 7). The positive correlation shows that richer countries tend to have a labor force which is better equipped with digital skills. However, some countries, like Central European economies (Czech Republic, Hungary and Slovakia) have a well digitally skilled labor force relative to the level of income. Other economies, like Italy and Ireland, but also Romania and Bulgaria, have an ill-equipped labor force relative to their level of income. Hence, in order to reap the full benefits of digital technologies and to be able to adapt technologies from the frontier, the latter countries will have to increase the digital skills of the work force.

Economic resilience in CEE endures. While the global and Euro Area business cycles slow, the economic expansion remains surprisingly strong in CEE. The region shows a high degree of economic integration with the Euro Area, yet strong domestic demand more than compensates for the weakening external conditions. Improvements in labor markets have been broad based, and rising wages support household consumption as, so far, inflation has remained rather muted. The region’s strong growth performance drives economic convergence. For it to persist, digital capacities will be essential to close the gap to an evolving technological frontier.

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Wiener Börse Party #1056: ATX minimalistisch zu neuem Rekord, Wienerberger top, hohe Volumina Erste Group, Opening Bell Claudia Eder

Bildnachweis

1.

ECB projection of 2019 Euro Area GDP growth over time

2.

Economic growth in CEE

3.

Domestic gross value added in gross exports

4.

GDP growth by main expenditure category in CESEE

5.

CEE Unemployment rates

6.

Inflation Rates in CEE

7.

GDP per capita

8.

Digital Skills vs GDPpc Rank

9.

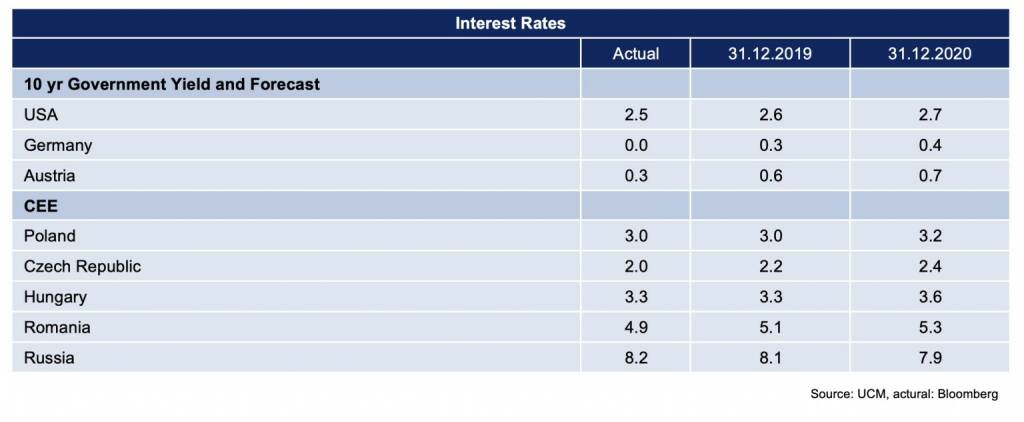

Interest Rates

Aktien auf dem Radar:VIG, Austriacard Holdings AG, Amag, Pierer Mobility, EuroTeleSites AG, Addiko Bank, CPI Europe AG, Wienerberger, Zumtobel, BKS Bank Stamm, Oberbank AG Stamm, Kapsch TrafficCom, AT&S, EVN, Flughafen Wien, Österreichische Post, Semperit.

Random Partner

Addiko Group

Die Addiko Gruppe besteht aus der Addiko Bank AG, der österreichischen Mutterbank mit Sitz in Wien (Österreich), die an der Wiener Börse notiert und sechs Tochterbanken, die in fünf CSEE-Ländern registriert, konzessioniert und tätig sind: Kroatien, Slowenien, Bosnien & Herzegowina (wo die Addiko Gruppe zwei Banken betreibt), Serbien und Montenegro.

>> Besuchen Sie 62 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Wiener Börse Party #1056: ATX minimalistisch zu neuem Rekord, Wienerberg...

» Österreich-Depots: Knapp unter High (Depot Kommentar)

» Börsegeschichte 16.12.: Extremes zu Erste Group (Börse Geschichte) (Börs...

» Wiener Börse am Nachmittag unverändert: Wienerberger, Austriacard und UB...

» Nachlese: Heiko Thieme Investor Relations, Jahreswechsel Info (audio cd.at)

» Research zu RBI, News zu Flughafen Wien, Frequentis, Kapsch TrafficCom, ...

» Öko-Invest-Editorial ausnahmsweise von Christian Drastil (Christian Dras...

» LinkedIn-NL: Mit meinen Offline-Kabarettisten (samt Veranstaltungen) und...

» Börse-Inputs auf Spotify zu u.a. VIG Verdoppler, Roland Meier, BNP Parib...

» ATX-Trends: RBI, Polytec, VIG, Uniqa ....

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wiener Börse Nebenwerte-Blick: Austriacard steigt...

- Wiener Börse: ATX geht behauptet aus dem Dienstag...

- Wiener Börse Party #1056: ATX minimalistisch zu n...

- Wie Zumtobel, Austriacard Holdings AG, Addiko Ban...

- Wie Wienerberger, SBO, OMV, Andritz, Bawag und CP...

- Österreich-Depots: Knapp unter High (Depot Kommen...

Featured Partner Video

kapitalmarkt-stimme.at daily voice: Presenter für eine der wichtigsten Peer Groups gesucht, dazu die Sache mit den ca. 2500

kapitalmarkt-stimme.at daily voice auf audio-cd.at: Presenter für eine der wichtigsten Peer Groups gesucht, dazu die Sache mit den ca. 2500. In eigener Sache.

Unser Ziel: Kapitalmarkt is c...

Books josefchladek.com

The Romance industry

2002

Nazraeli

Genocídio do Yanomami

2025

Void

So lebt man heute in Rußland

1957

Blüchert

Il senso della presenza

2025

Self published

Allied Forces

Allied Forces Elizabeth Alderliesten

Elizabeth Alderliesten Adriano Zanni

Adriano Zanni Pieter Hugo

Pieter Hugo Oliver Gerhartz

Oliver Gerhartz