24.05.2019, 7876 Zeichen

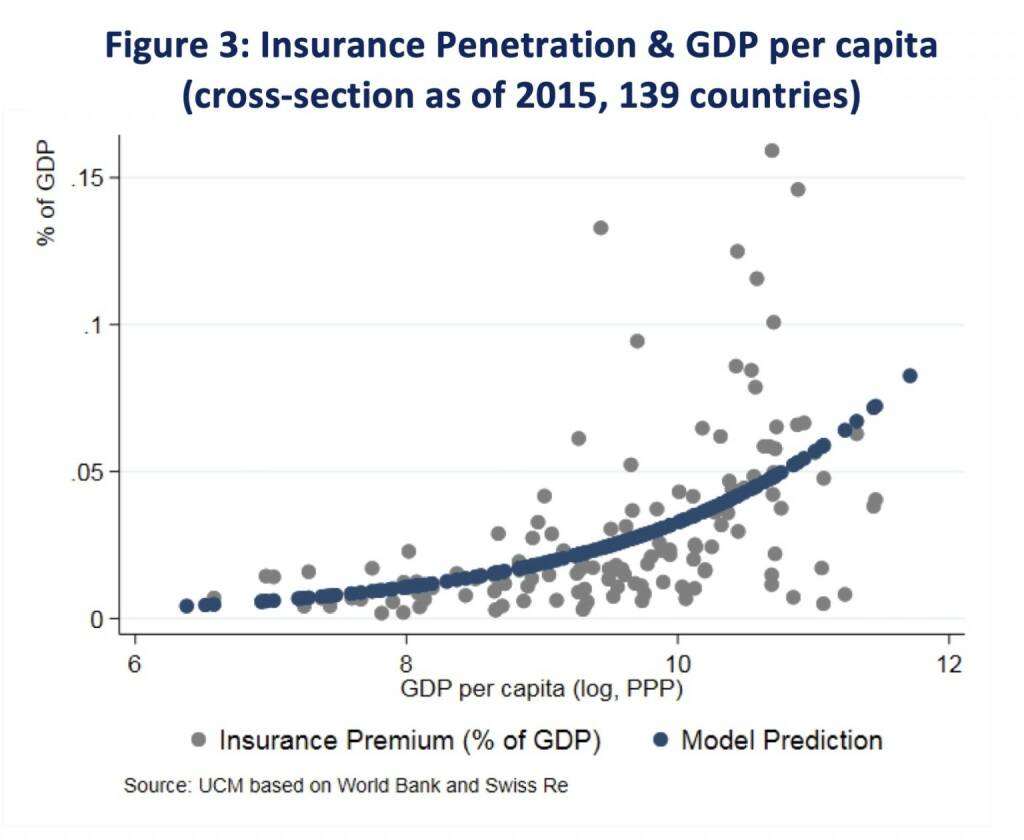

- The Czech economy is the first to reach current German income per capita in 2046, while Ukraine would be the last to reach today’s German living standards in 2077.

- Insurance markets grow with income by more than 1:1 during transition. Thus, continued convergence in income levels is set to foster convergence in insurance penetration.

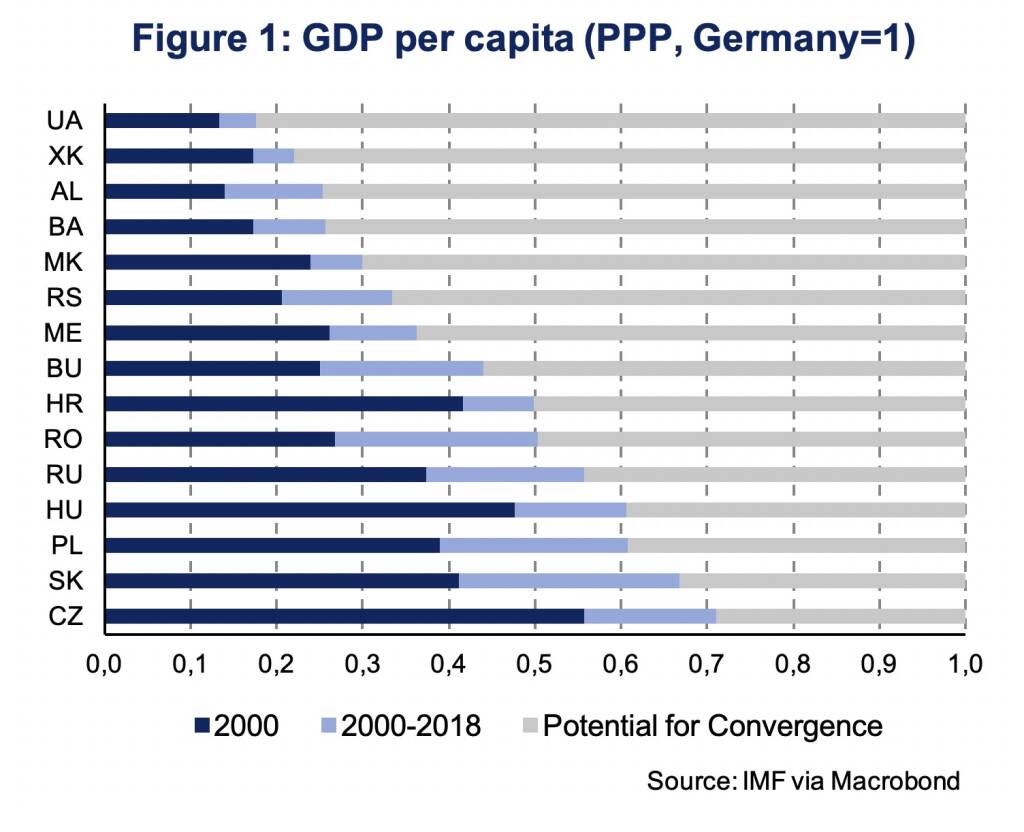

Countries with lower income per capita have higher growth prospects and a catch-up with richer countries implies a higher growth rate of insurance premiums. Important determinants of insurance development include income, wealth, the price of insurance, anticipated inflation, real interest rates, the role of the stock market, unemployment, demographic factors, risk aversion, the educational level, religion and culture, financial development, market structure, social security, the legal and regulatory environment and political risk and governance [1]. In more abstract terms, some of these factors are referred to as institutions or ultimate sources of growth. Bad institutions constrain convergence while good institutions enable long-term prosperity. In an ideal world we can abstract from these factors and ask how unconditional income and insurance convergence in transition economies in Central and Eastern Europe (CEE) would look like. In this research note, we estimate this potential for convergence.

In the standard economic growth model, the Cobb-Douglas production function has the form where output (Y) depends on the factors of production capital (K), labor (L) and productivity (A) in period t and is the capital share of income. This implies output per labor where k is capital per labor. Further, we denote growth rates by g for the growth rate of productivity and n for population growth. It can be shown that economic growth evolves by (see image two above)

where is the change in output in period t, is the depreciation rate of capital and denotes the steady-state output. In the model, there are two sources of growth: the rate of technological progress, g, and “convergence”, given by the second term of the right-hand side of the equation. The main assumption in the standard growth model are diminishing returns: Capital (machines, factories) catches up until it reaches a steady-state in which its marginal product (i. e. its return) equals the rate of depreciation. The convergence term says that the farther away output from its steady-state level the higher the speed of the catch-up process. Once an economy has reached its steady-state output level , the second term drops and the economy purely grows by technological progress. It is usually referred to as unconditional convergence as there are no constraints or barriers to convergence. It can also be thought of as a convergence potential of an economy.

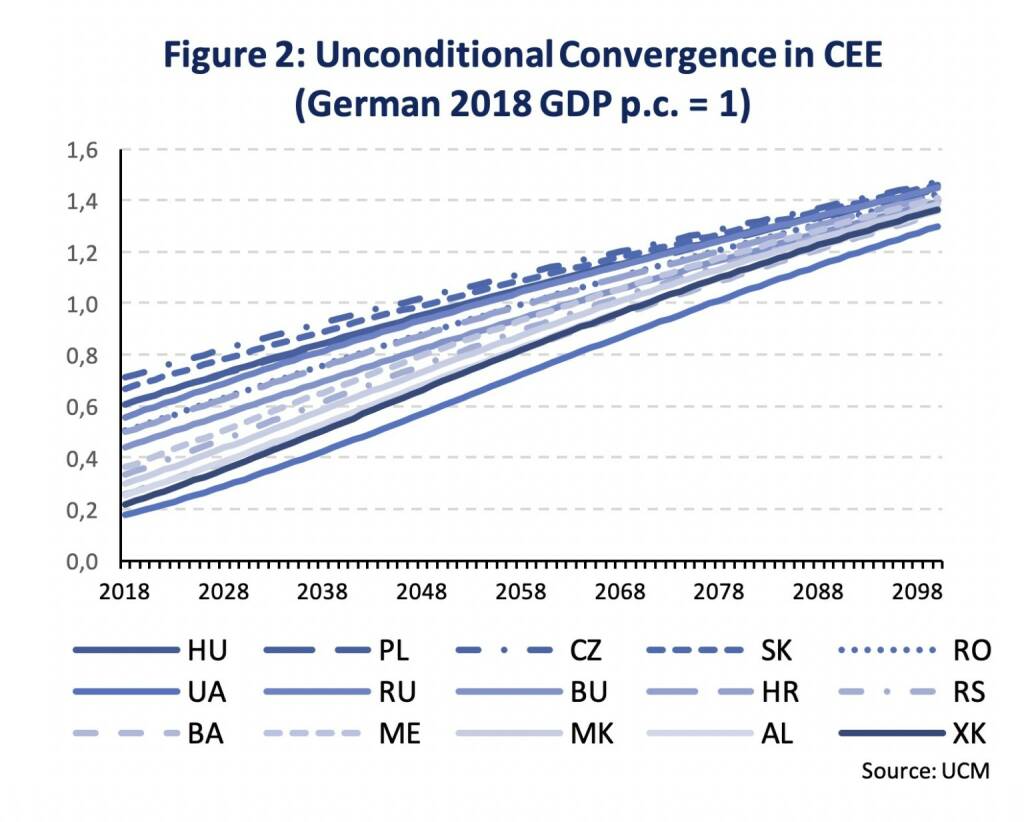

We apply the above model to transition economies in CEE. Figure 1 shows the per capita gross domestic product (GDP) at purchasing power parities (PPP) relative to Germany; the technological frontier.

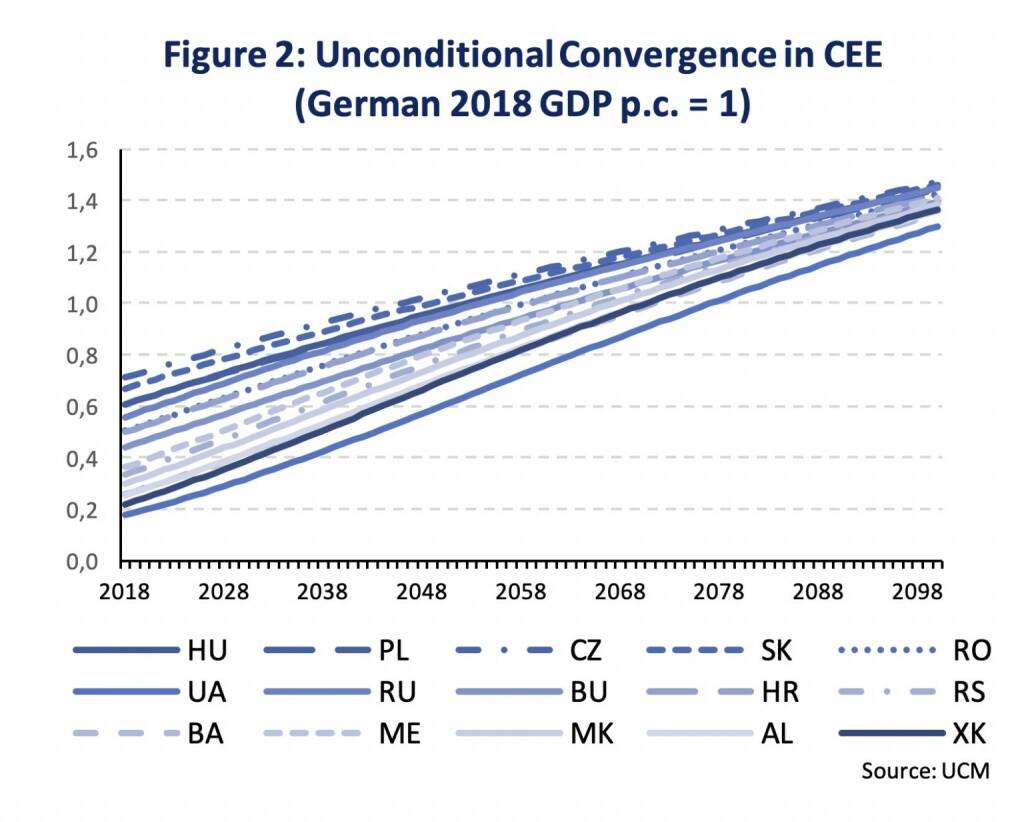

The GDP per capita level in 2018 relative to Germany gives a proxy for the starting level of for each CEE economy in the model. Technological progress (g) is assumed to grow by 0.5 % per anno (average growth of German total factor productivity between 1990 and 2017 according to the Conference Board) and the German economy is assumed to keep growing at 0.5 % annually. The constant n is proxied by the average %-change in the country-specific working-age population between 2018 and 2050 (United Nations Population Division, demographic projections, medium fertility). All countries exhibit average annual declines in the working-age populations ranging from -0.5 % (Montenegro) to -1.2 % (Bulgaria), which slow down the convergence process. The capital share of income is set at 1/3 and the annual depreciation rate is assumed at 5.0 %. The unconditional convergence process relative to German GDP per capita (PPP) is depicted in Figure 2.

In 2046, the Czech economy is the first to reach today’s income per capita in Germany and Ukraine is the last one to reach Germany’s living standards in 2077. Central Europe (Hungary, Poland, Czech Republic and Slovakia) is the first region to complete the catch-up process until 2053. Countries from the Western Balkan (Albania, North Macedonia, Bosnia & Hercegovina) starting with less than 1/3 of Germany’s living standards are among the catch-up laggards.

Economic convergence has direct effects on insurance markets, as insurance premia rise with income at a rate faster than 1:1 during transition. Table 1 shows the average insurance penetration (insurance premium as a % of GDP) by income group in 2010-2015 (most recent data for a global sample). High income countries had an insurance penetration of 4 %, 2.4 %-age points of which being attributed to life insurance and 1.6 %-age points to non-life insurance. In middle income countries insurance penetration is markedly lower at 1.2 % declining to 0.7 % in low income countries. Moreover, in contrast to high income countries non-life insurance attributes for a larger share of total insurance premium than life insurance. In low income countries (GNI per capita below 1025 USD) life insurance penetration is at 0.2 % of GDP.

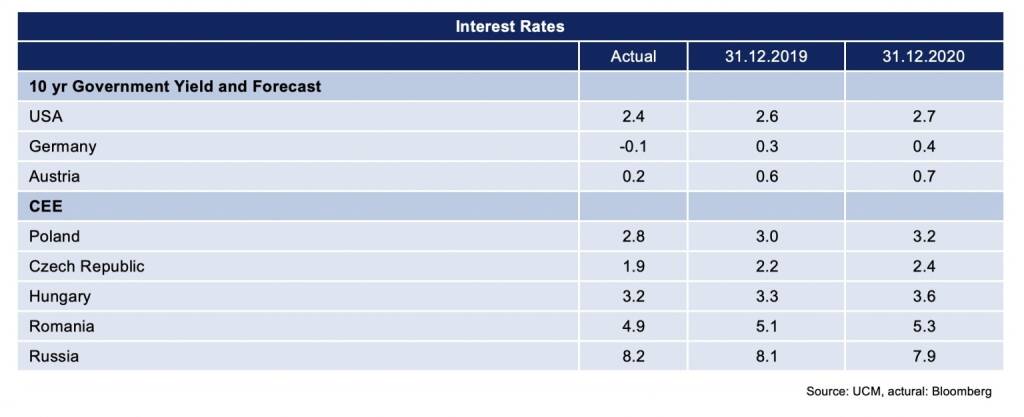

Looking at individual countries, rather than aggregates, shows more diversity, yet a positive correlation between income per capita and insurance penetration is clearly visible (correlation coefficient of 0.5). Figure 3 plots the logarithm of GDP per capita (PPP) in 2015 on the horizontal axis and insurance penetration for a sample of 139 countries (World Bank Global Financial Development Database) on the vertical axis. Insurance penetration is modelled by applying a generalized linear model (GLM) with a binominal model family and a logit link function (logistic regression) using the log of GDP per capita as the sole explanatory variable [2]. As expected, the model predicts a highly statistically significant positive relationship. Country specific deviations from the predicted insurance penetration occur in both directions.

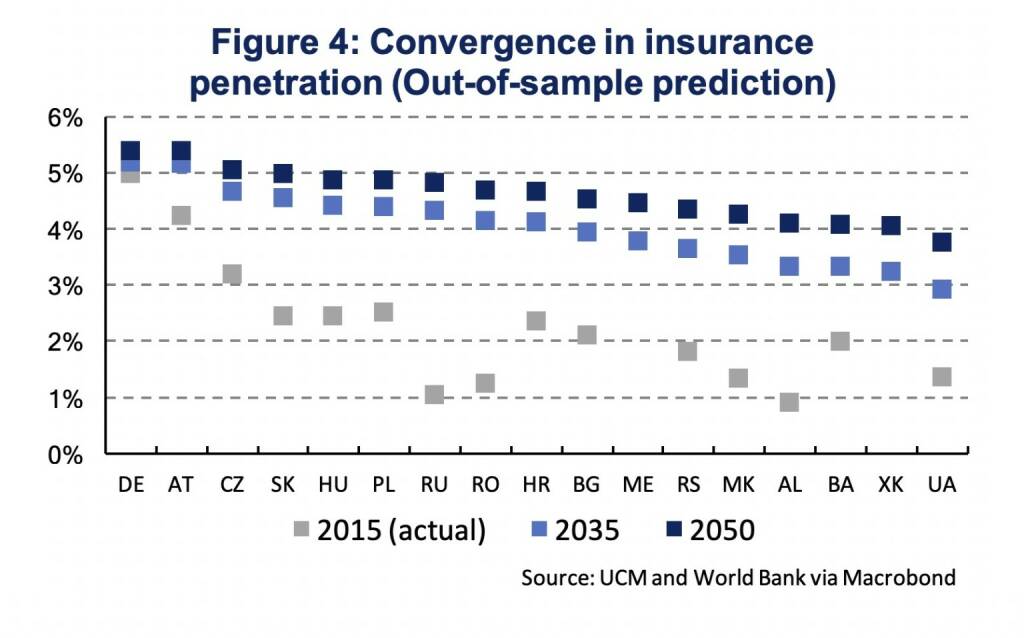

Combining the theoretical model of unconditional convergence with the empirical relationship between GDP per capita and insurance penetration, we can give a rough indication about the implications of convergence for insurance markets in CEE. It should, however, be noted that consistent with unconditional convergence, country specific factors have been left aside such that projected values of insurance penetration reflect a predicted mean at a specific income level rather than a country-specific prediction. Figure 4 shows the actual levels for 2015 alongside the model out-of-sample predictions for the years 2035 and 2050, based on income levels from the unconditional income convergence model. It can be seen that considerable catch-up potential in insurance penetration exists for the CEE region. By 2050 all CEE countries could be close to an insurance penetration rate of Austria today (2018: 4.5 %). Insurance penetration would more than double for the average CEE country by 2050. To what extent convergence in income levels and insurance penetration will follow our unconditional projections will, however, be determined by the right conditions to be put in place to foster catch-up growth.

[1] Ertl (2017): „Insurance Convergence and Post-crisis Dynamics in Central and Eastern Europe“, The Geneva Papers on Risk and Insurance 42 (2): 323-347, https://link.springer.com/article/10.1057/s41288-017-0043-6.

[2] This approach follows the method proposed by Papke and Wooldridge (1996) to fit models with proportional outcome variables: Papke and Wooldridge (1996): “Econometric methods for fractional response variables with an application to 401(k) plan participation rates”, Journal of Applied Econometrics 11: 619–632.

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Wiener Börse Party #1089: ATX nach Rücksetzer wieder etwas erholt; Verbund und Bawag (auch nach Ende Rückkaufprogramm) gesucht

Bildnachweis

1.

GDP per capita

2.

Formula

3.

Unconditional Convergence in CEE

4.

Insurance Penetration by Income Group

5.

Insurance Penetration & GDP per capita

6.

Convergence in insurance penetration

7.

Interest rates

Aktien auf dem Radar:AT&S, Andritz, OMV, EuroTeleSites AG, Austriacard Holdings AG, Amag, Österreichische Post, Lenzing, CPI Europe AG, Telekom Austria, Semperit, Flughafen Wien, VIG, DO&CO, Gurktaler AG Stamm, Josef Manner & Comp. AG, Bajaj Mobility AG, Verbund, Warimpex, Addiko Bank, Palfinger, BKS Bank Stamm, Oberbank AG Stamm, Reploid Group AG, Marinomed Biotech, Agrana, CA Immo, EVN, Zumtobel.

Random Partner

Warimpex

Die Warimpex Finanz- und Beteiligungs AG ist eine Immobilienentwicklungs- und Investmentgesellschaft. Im Fokus der Geschäftsaktivitäten stehen der Betrieb und die Errichtung von Hotels in CEE. Darüber hinaus entwickelt Warimpex auch Bürohäuser und andere Immobilien.

>> Besuchen Sie 59 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Österreich-Depots: Weekend Bilanz (Depot Kommentar)

» Börsegeschichte 6.2.: Wienerberger, Warimpex (Börse Geschichte) (BörseGe...

» Nachlese: Daniela Herneth Superpower, Edi Berger, Stefan Maxian (audio c...

» Wiener Börse Party #1089: ATX nach Rücksetzer wieder etwas erholt; Verbu...

» PIR-News: In den News: Strabag, Bawag, Post, Bajaj Mobility/KTM (Christi...

» Wiener Börse zu Mittag fester: Verbund, Bawag und Do&Co gesucht

» Börse-Inputs auf Spotify zu u.a. Veronika Rief, Addiko Bank, Edi Berger,...

» ATX-Trends: AT&S, Erste Group, Bawag, RBI, OMV ...

» Börsepeople im Podcast S23/11: Daniela Herneth

» Österreich-Depots: Rekord (Depot Kommentar)

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

- Wie Gurktaler AG Stamm, Josef Manner & Comp. AG, ...

- Wie Andritz, Verbund, DO&CO, Porr, VIG und SBO fü...

- Österreich-Depots: Weekend Bilanz (Depot Kommentar)

- Börsegeschichte 6.2.: Wienerberger, Warimpex (Bör...

- Nachlese: Daniela Herneth Superpower, Edi Berger,...

- Unser Volumensradar sagt: AT&S (#gabb Radar)

Featured Partner Video

BörseGeschichte Podcast: Ernst Vejdovszky vor 10 Jahren zum ATX-25er

Der ATX wurde dieser Tage 35. Rund um "25 Jahre ATX" haben wir im Dezember 2015 und Jänner 2016 eine grossangelegte Audioproduktion mit dem Ziel einer Fest-CD gemacht, die auch auf Audible als Hörb...

Books josefchladek.com

Stahlrohrmöbel (Catalogue 1934)

1934

Selbstverlag

Ctonio

2024

Studiofaganel

Photographie n'est pas L'Art

1937

GLM

Flatlands

2023

Hartmann Projects

Typografische Entwurfstechnik

1932

Akadem. Verlag Dr. Fr. Wedekind & Co

Otto Wagner

Otto Wagner Anna Fabricius

Anna Fabricius Jacques Fivel

Jacques Fivel Raymond Thompson Jr

Raymond Thompson Jr